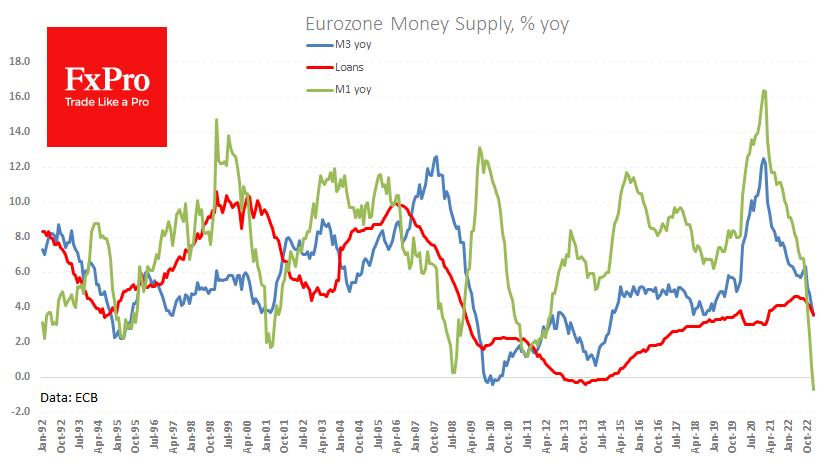

Money supply and lending in the eurozone are slowing faster than expected, indicating an imminent economic contraction.

Data released on Monday morning pointed to a slowdown in new lending, coinciding with the start of the euro zone’s interest rate hike cycle. Loans rose by 3.6% year-on-year, compared with 3.8% in the previous month and an expected acceleration to 3.9%.

The annualised growth rate of M3 slowed to 3.5% yoy from 4.1% at the end of last year. The deceleration was stronger than the expected 3.9%. The money supply in Europe is not keeping pace with inflation, which was 8.6% in January and is expected to slow to 8.2% in February.

For the first time since 1981, the monetary aggregate M1 declined year-on-year. Such a development is often seen as an anti-inflationary indicator.

At the same time, the ECB continues to reduce its balance sheet by 962 billion or 11% since its peak in June. The most significant contributor to the decline in central bank assets has been the completion of regular liquidity programmes. The Fed’s balance sheet was 6.3% below its peak.

For the economy, falling credit and a slowdown in lending are essential signals of an economic downturn.

From a fundamental point of view, this is negative data for the euro as it could lead the ECB to start easing policy sooner. However, this data has little impact on the currency as most traders await the release of February inflation estimates later in the week.

The FxPro Analyst Team