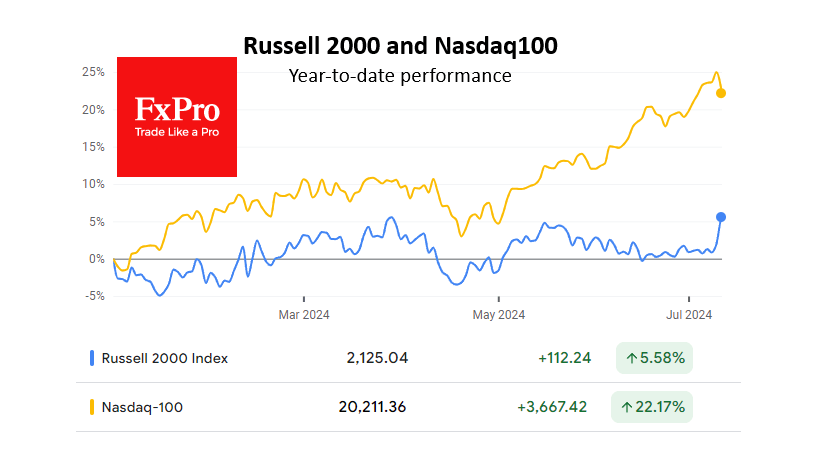

Indices in the US went in different directions. While the market’s flagship gainer of recent years, the Nasdaq100, has lost nearly 2.9% from its peak just after the CPI data, the index of small-cap companies, the Russell 2000, has soared 4.7% to date.

We saw one of the most notable one-day rotations in market history. This is only the second time since 1979 that the Russell 2000 has closed the day up over 3% (it was up 3.6%) against the backdrop of a decline in the S&P500. Considering the magnitude of the S&P500 and Nasdaq100 decline (0.7% and 2.3%, respectively), this was the largest divergence that occurred quite suddenly.

It’s easy to find justifications for a rally in a small-company index. A slowdown in inflation is a historically positive signal for such firms. Typically, during these periods, companies rebuild margins, getting a chance to keep up with the largest corporations.

It’s no secret that in previous months, the market has been pulled upward by a narrow AI narrative, while the breadth and strength of the stock market rally have been at “extreme fear” levels. Moreover, the Russell 2000 has been losing ground smoothly since May, pulling back deep into a multi-year range, while the Nasdaq100 has been methodically updating all-time highs since mid-May.

A sign of inflation is behind this big trade. April CPI data released in mid-May confirmed an acceleration in the pace of price increases and spooked markets so much that some speculated the next move would be a rate hike, not a rate cut. From this perspective, the Russell2000 index performed according to classic rules, giving up ground for a month after the strong May CPI release, sideways on neutral data in June, and soaring on the July release.

Following this logic, the Russell 2000 is poised for a prolonged rally, a strong start to what we saw the day before. Right now, the index has climbed to the March 2024 peak levels, which, if broken, would take it to its highest level since January 2022. The Russell 2000 needs to rise 13.5% to reach the all-time highs set in November 2021. That’s not a lot, given the average annual performance, but it’s not so much when you look at how fast the index usually rallies.

A small-company index rally can provide the S&P500 and Nasdaq100 with that much-needed “breadth” and “strength,” adding flesh to that ‘Artificial narrative.

The FxPro Analyst Team