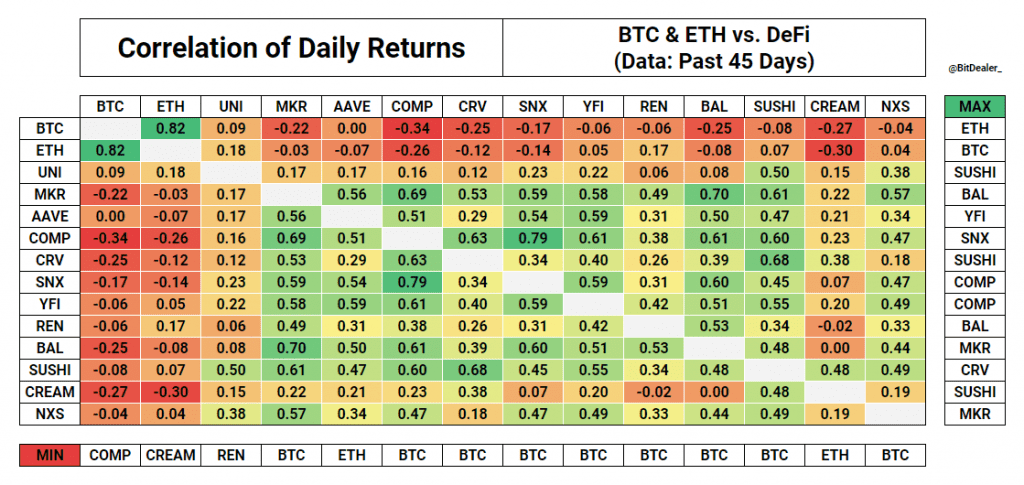

The co-founder of crypto data aggregator Markets Science, Twitter-user ‘Bitdealer,’ has shared a chart indicating negative correlations between 11 top DeFi tokens and BTC over the past 45 days to Nov.1, with AAVE showing neutral correlation and UNI showing confluence if less than 0.1.

Seven of 13 DeFi tokens were also found to have negative correlations with Ethereum (ETH), despite Ethereum powering much of the DeFi ecosystem. With many decentralized finance (DeFi) tokens struggling while Bitcoin (BTC) surged in price this week, analysts have identified a longer negative correlation between DeFi tokens and BTC.

However, the sector found its speculative plateau by the end of August, with Binance’s DEFI Composite Index crashing 64% from $1,100 at the start of September to less than $400 as of this writing. TokenSet’s DeFi Pulse Index (DPI) has also shed more than half its value since launching at $130 in mid-September. DPI tokens last traded hands for just $61.55.

Meanwhile, Bitcoin’s price has increased by more than one-third in the past month, rallying to tag $14,000 at the end of October after global payments giant PayPal announced it was entering the crypto sector.

Trade activity on decentralized exchanges (DEXs) also appears to have reversed, with monthly DEX volume falling from close to $26.3 billion in September to roughly $19.4 billion last month. Only a handful of DEXs have a significant share of the sector’s volume, with Uniswap and Curve representing 75% of decentralized trade in September. The past three months’ worth of Uniswap volume equates t45% of total DEX volume since November 2019.

Zero-sum game: DeFi declines while Bitcoin booms, CoinTelegraph, Nov 3