– WTI crude oil reversed from the multi-year support level 66.70

– Likely to rise to resistance level 70.00

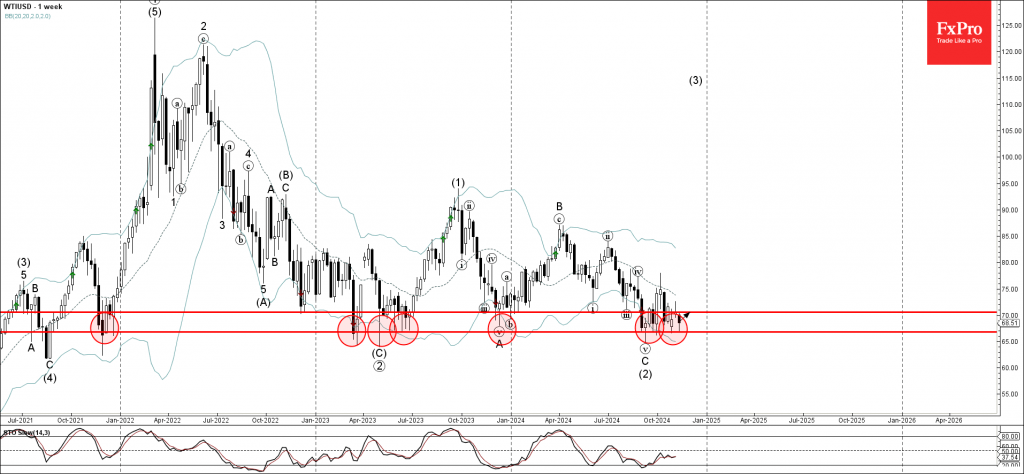

WTI crude oil recently reversed up from the powerful multi-year support level 66.70 (which has been repeatedly reversing WTI from the end of 2021, as seen from the weekly WTI chart below).

The support level 66.70 was strengthened by the nearby lower daily and the weekly Bollinger Bands.

Given the strength of the nearby support level 66.70 and the bullish divergence on the weekly Stochastic indicator, WTI crude oil can be expected to rise to the next resistance level 70.00.