Global stock prices inched higher while U.S. bond yields hovered near a 13-month peak on Monday as investors bet U.S. economic growth will accelerate after the $1.9 trillion stimulus bill President Joe Biden signed into law last week. The rollout of COVID-19 vaccinations in the United States and some other countries stoked a bullish mood on risk assets even as investors become wary of key central bank policy meetings later in the week, including the U.S. Federal Reserve’s.

“The U.S. is now vaccinating more three million people a day, with President Biden now saying all adults will be able to get a shot by May 1. It could soon achieve a herd immunity and an economic normalisation,” said Norihiro Fujito, chief investment strategist at Mitsubishi UFJ Morgan Stanley Securities. European shares are expected to open higher, with Euro Stoxx 50 futures up 0.3% and FTSE futures trading 0.5% higher.

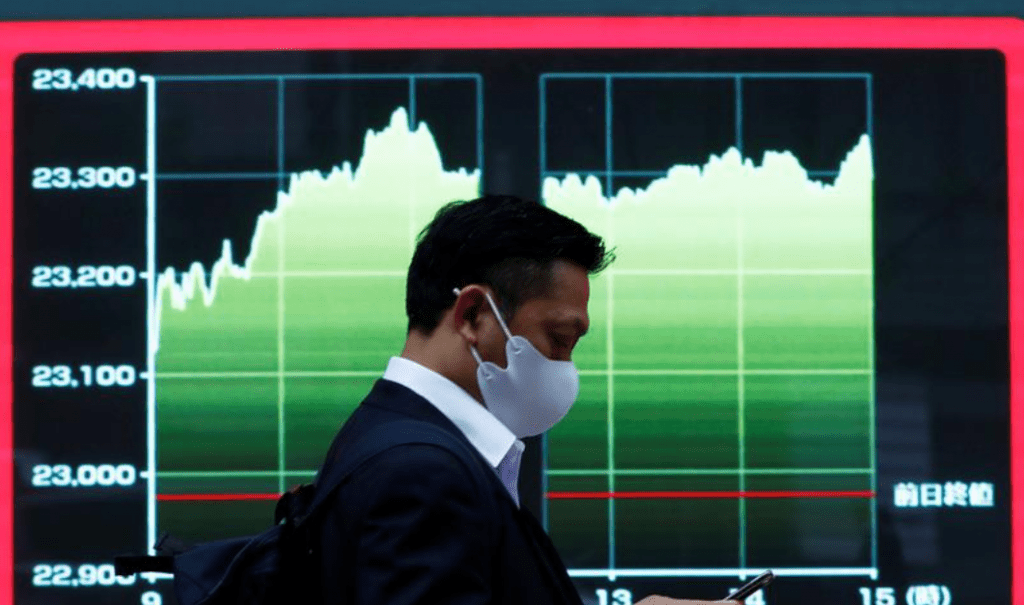

U.S. S&P500 futures rose as much as 0.37% in Asia before erasing gains, trading just below a record high level touched last week, while Japan’s Nikkei ticked up 0.2%. Mainland Chinese shares, however, dropped despite data showing a quickening in industrial output and a rise in retail sales, with bluechip CSI 300 index falling 2.6% on policy tightening worries.

The U.S. House of Representatives gave final approval last week to the COVID-19 relief bill, giving Biden his first major victory in office. The 10-year U.S. Treasuries yield stood at 1.634%, having risen to as high as 1.642% on Friday, a high last seen in February last year. Higher U.S. bond yields saw the dollar rising against other major currencies. The euro slipped 0.2% to $1.1929 from last week’s high of $1.1990 while the dollar hit a nine-month high of 109.27 yen. The British pound slipped 0.5% to $1.3902.

World stocks inch up on stimulus, vaccines hopes, Reuters, Mar 15