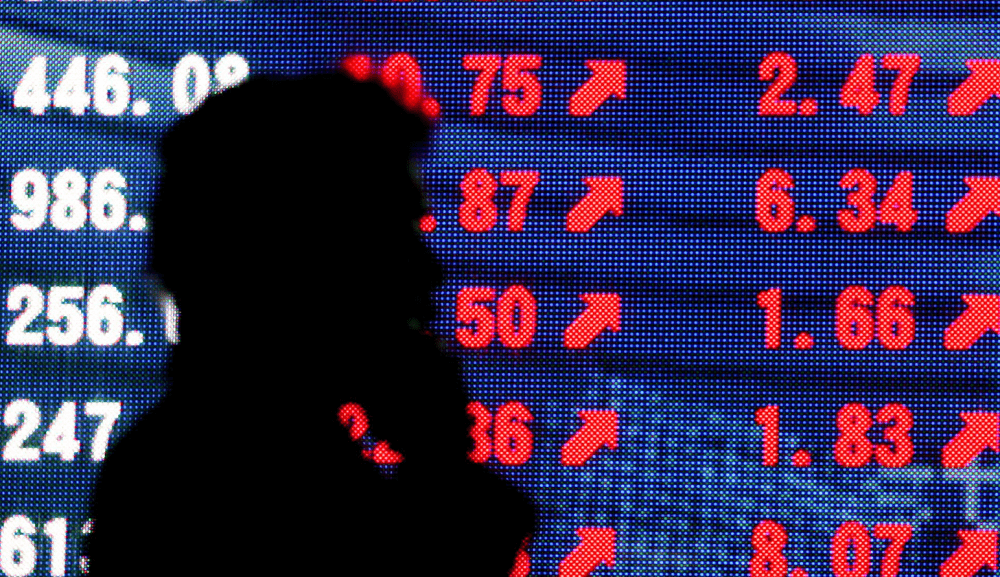

Share markets struggled globally on Friday in a shadow cast by overnight falls in U.S. big tech shares, as well as doubts about the prospects for a U.S. stimulus after the Senate rejected a Republican bill. European stocks are expected to trade slightly lower, with euro stoxx 50 futures down 0.1%. In Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.2%, thanks to a rebound in Hong Kong and Chinese shares, but it still hovered just above a one-month trough touched earlier this week. Japan’s Nikkei rose 0.6%.

Dampening the mood, the U.S. Senate on Thursday killed a Republican bill that would have provided around $300 billion in new coronavirus aid, as Democrats seeking far more funding prevented it from advancing.

Data also showed the number of Americans filing new claims for unemployment benefits remained high last week, and the total number of people who are on unemployment benefits increased to 29.6 million. U.S. tech shares, unquestionable leaders of the world’s stock recovery since late March, failed to sustain a brief rebound. On Wall Street on Thursday, the S&P 500 lost 1.77% while the Nasdaq Composite dropped 1.99%, both on course for a second straight week of losses.

The NYSE Fang+ index of big 10 tech companies has lost 5.4% so far this week — its biggest weekly loss since the market turmoil in March if sustained by the end of Friday. Still, the index is more than double its March trough and investors have gathered that their high valuations are justifiable in light of near zero interest rates in much of the developed world and massive liquidity the world’s central banks have created. Many investors have said the selloff was a healthy correction.

World shares struggle to shake off bearish mood as U.S. tech giants wobble, Reuters, Sep 11