Global shares stepped back on Wednesday as soft U.S. retail sales fuelled worries that rising coronavirus cases could stifle a still fragile economic recovery, dampening the euphoria from vaccine trial breakthroughs. U.S. S&P500 futures shed 0.4%, a day after the S&P500 index lost 0.48%, while Europe’s Euro Stoxx 50 futures eased 0.3%.

Japan’s Nikkei fell 1.1%, bruised by news that new coronavirus cases in Tokyo hit a record high near 500 and reports that the city may ask businesses to shorten their hours again. But many Asian markets bucked the trend, with MSCI’s broadest index of Ex-Japan Asia-Pacific shares rising 0.3%, helped by better handling of the pandemic in much of the region and a continued pick up in China’s economic recovery.

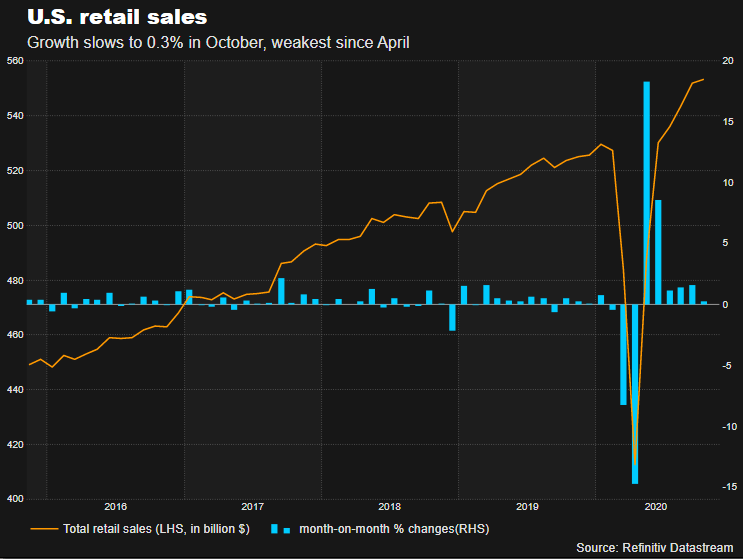

The retail sales report released by the U.S. Commerce Department showed spending decelerating as the holiday shopping season approaches, amid a lack of fresh fiscal relief from Washington. A skittish mood also swept investors as several U.S. states began restricting gatherings and mandating face-coverings after more than 70,000 Americans were hospitalized for treatment of COVID-19.

The surge in new coronavirus cases comes as investors have hailed two promising vaccine trial results published earlier this month. U.S. Federal Reserve Chairman Jerome Powell noted the current surge in coronavirus cases is a big concern, and the economy will continue to need both fiscal and monetary policy support.

Bond yields have come down with the 10-year U.S. Treasuries dropping to 0.847%, its lowest level since Nov. 9 and off 7 1/2-month high of 0.975% touched last week. Falling U.S. yields put pressure on the U.S. dollar, against the yen in particular. The dollar slipped 0.2% to 104.01 yen, erasing more than a half of its gains made on Monday last week following the news about COVID-19 vaccine development. The euro moved little at $1.1875 while the Chinese yuan hit a 2 1/2-year high of 6.5318 per dollar in the offshore trade. Sterling held firm after UK tabloid the Sun reported that Britain could reach a post-Brexit trade agreement with the European Union by early next week. The pound changed hands at $1.3252, not far from two-month peak of $1.3322 hit a week ago.

World shares slip as U.S. retail sales dampen vaccine euphoria, Reuters, Nov 18