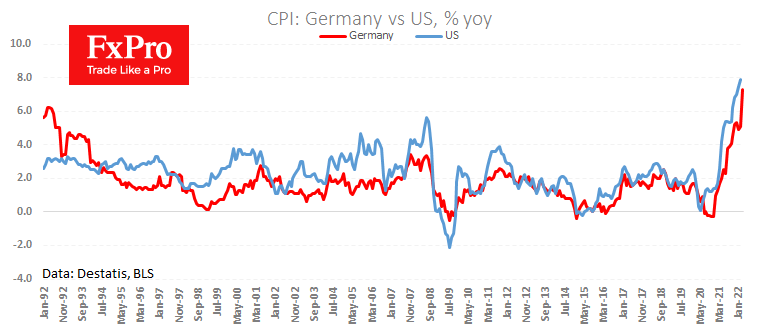

In Germany, the final consumer price index data confirmed that inflation reached 7.3% y/y in March – the highest since 1981. This is a worrying reading, but it is already priced in as it coincided with the preliminary estimates released at the end of March.

Much more worrying is the jump in wholesale prices in March by 6.9% m/m and 22.6% y/y. The highest price jump since 1969 promises even more upward pressure on consumer prices by a considerable margin.

German representatives have taken one of the most hawkish stances against inflation. Record inflation figures and the potential for further acceleration will probably force the ECB to shift from pro-growth to anti-inflationary.

It is worth paying increased attention to the change in the tone of ECB head Lagarde’s comments following tomorrow’s meeting. While no policy changes are expected, all eyes will be on the willingness to raise rates in the coming months. Markets are laying down two hikes before the end of the year.

The latest inflation data could precipitate a hawkish reversal by the ECB and deliver this to the public as early as tomorrow, triggering a reassessment of the outlook in the euro. If that doesn’t happen, we could witness an imminent capitulation of the buyers of the single currency and see EURUSD below 1.0 in the next six months.

The FxPro Analyst Team