The rebound in financial markets that we have seen since the beginning of last week seems to have stalled. Various key market indices are showing signs of growth fatigue. The rebound is mainly related to the depth of the previous fall. However, yesterday’s reversal to the downside was suspiciously synchronised, suggesting a new round of declines that may take the markets below the last local lows.

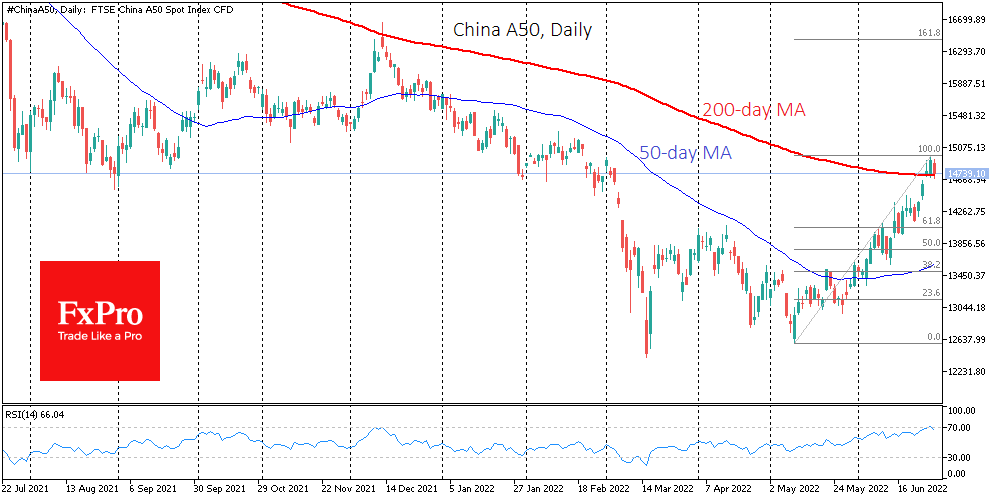

After a prolonged drop since February 2021, the Chinese market has been gaining weight for the past month and a half. But today, the China A50 is losing more than 1%, hitting resistance in the form of the psychologically significant circular level of 15000, the 200-day moving average, and after entering the overbought area of the RSI on the daily charts. In an unfolding correction, attention should be paid to the 14000 level. A fall under it would indicate that we are not seeing a tactical retreat but a new phase of the Chinese bear market.

Sellers returned to the US market as investors could not ignore the confirmation of worsening consumer sentiment. The Census Bureau Consumer sentiment index release marked a fall from 103.2 to 98.7, returning to its lowest point since February last year due to a sharp deterioration in expectations and once again confirming investor fears that the world’s largest economy is heading into a recession.

A recession is not yet a deal, and hence markets are far from factoring its risks into prices, so as signs of weakness in the US or global economy increase, it is logical to expect further retreat. And this process may continue until the monetary or financial authorities say something like “enough, stop”, proceeding from tightening the screws to neutral policy or stimulus.

The latest reversal has confirmed the idea that the S&P500 will soon test support at the 200-week average near 3500, which is more than 8% below current levels and 11% below the peak of the latest bounce.

Short term, the UK market looks better than China and US markets, where the FTSE100 is not only down less than its peers but is even adding in Wednesday’s trading. Much of this is due to the long-term depressing nature of this index, which has been trying unsuccessfully to get above the 7500 area, and the general euphoria of the markets after the pandemic has not helped. Now the accumulated weakness over the years is playing into the hands of the FTSE100, suddenly turning it into a defensive asset as it is filled with stocks of commodities companies, benefiting from commodity price booms and a reorientation of supplies, excluding Russia.

The FxPro Analyst Team