Although US retail sales figures are often the more important news, their slight overshooting relative to expectations has, in our view, less impact on markets than the import price index.

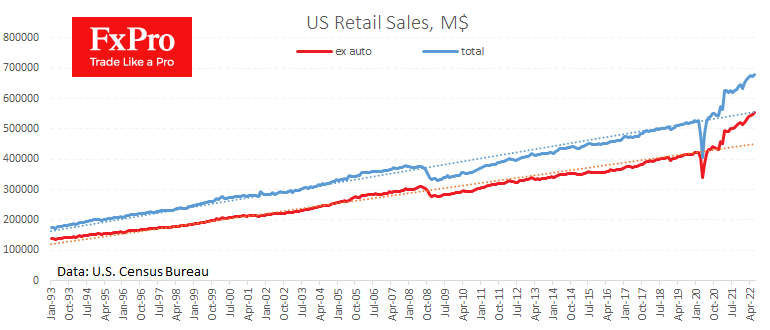

According to preliminary estimates, US sales rose by 1% in June against expectations of 0.9% and a 0.1% contraction a month earlier. Not too much better than expected, given that volume is not price-adjusted, which was higher than expected earlier in the week.

The good news for market participants is the cooling of import price increases. For the month, the index added 0.2% vs 0.7% expected and to 10.7% y/y versus 11.6% a month earlier, with 12.1% forecasted.

This deceleration results from the correction in commodity prices and the strengthening of the dollar in previous weeks. But most importantly, this index indicates that the peak of the rate of price increases is over.

More signs of a bullish trend reversal in prices might ease the Fed’s pressure on the key rate. Market participants are now trying to weigh the chances of a one percentage point hike in a week and a half. A softening of their expectations could trigger a corrective pullback in the dollar and an attempted equity market recovery.

The FxPro Analyst Team