Asian markets are moving upwards, gaining support from Wall Street’s bounce overnight. The S&P500 and Dow Jones added more than 1.5% on Monday after news that Democrat lawmakers presented a ‘compromise’ $2.2 trillion relief bill.

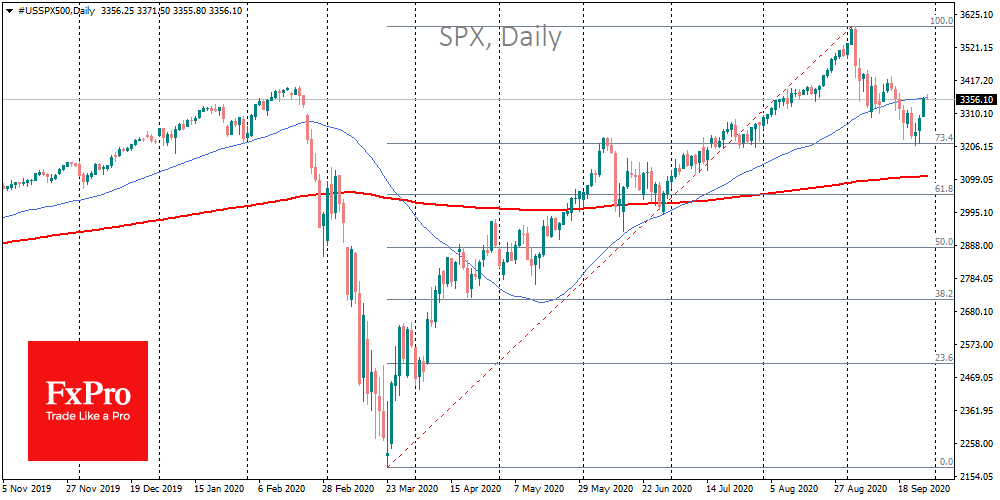

Hopes for fiscal stimulus on day four are fueling the market growth. S&P500 has added 4.7% over this time, bringing back about 40% of its slump since early September. On the technical side, the situation seems like a return to growth after a 23.6% retreat from the March-September rally.

Futures on the S&P 500 are now testing a 50-day average. Successful consolidation above this can clear the path to historical highs. But possibly the bears have not yet played their final card.

There are several obstacles ahead on the way up. Today there will be the first US presidential debate between candidates. Against this backdrop, traders will pay much more attention to the news headlines than to the technical picture. With a clear leadership of one of the opponents, the markets can cover strong movements with roughly equal chances for growth and decline.

It is generally considered that the triumph of democratic candidates is negative for markets. However, this is a too simplistic approach, and it is worth keeping a close eye on Biden’s promises. In the end, it may turn out that his words can further inspire the markets.

If this does not happen, there are high chances for deeper stock markets correction to update local lows. Potential targets of such move may stick to 38.2% of the March-September rally in 3050 area, which is 9% below current levels and dangerously close to the new bear market territory.

A similar binary scenario is now also relevant to the dollar. Further recovery in demand for risk assets will be negative for the US currency, returning it to a decline with potential targets below the September low, 2.7% below current levels.

If the markets scare off the slippage of the legislative aid package or the anti-market rhetoric of presidential candidates, demand for protective assets could gain momentum very quickly. If it snowballs, it runs the risk of causing the dollar to strengthen by another 2% in a matter of days, bringing DXY back into the trading range of June, which is also a significant support area for 2019.

The FxPro Analyst Team