The markets are preparing for the next Fed decision, the publication of which and subsequent Chairman Powell’s comments have the potential to trigger sharp market moves and set the tone for the days or even weeks ahead.

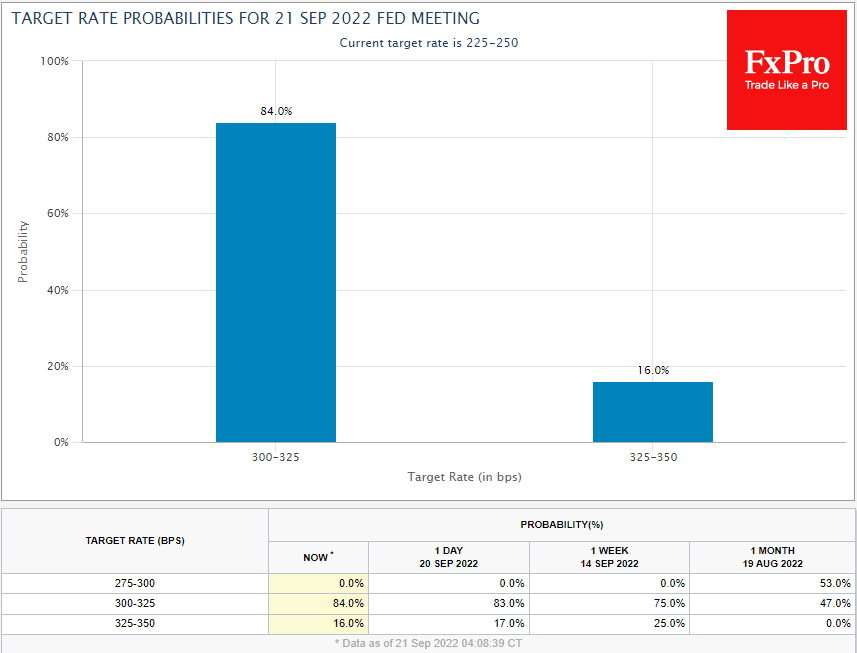

The rate futures market is laying down an 84% chance of a 75-point increase, leaving a 16% chance of a 100-point hike today. This is a very hawkish expectation that the market has been putting into prices since last Tuesday, causing a pull into defensive assets.

The money market has been renewing extremes in previous days, laying higher rates in prices for the longer term.

In the currency market, the dollar index has come close to the extremes set at the beginning of the month, trading now at 110.35, while GBPUSD, EURUSD and USDJPY have rewritten or come close to their multi-year extremums. All it takes is a slight nudge from this point to trigger an avalanche-like move in either direction. Everything will depend on the market’s perception of the Fed’s monetary policy plans.

In the week after the surprising US inflation report for August, the markets seem to have given up entirely on the idea that the Fed would lower the rate hikes. On the contrary, the market now appears to be going from one extreme to the other, expecting a 200-point rate hike before the end of the year. This creates the potential for “positive” surprises.

In our case, this could manifest in corrective sentiment on the dollar and a rebound in the equity market from local lows. For the equity market, a break of the downtrend may not come before a sure return of the S&P500 above 4150. The DXY ascent will not be called into question before a plunge below 107.70.

On the other hand, if the Fed remains adamant about tightening financial conditions despite market turbulence, a further push down in equities and a rise in the dollar could trigger an uncontrollable sell-off like the one we saw in March 2020, a near-freefall.

Such market stress could reverse Fed policy, as it did in 2020, 2018, 2015 and 2011. However, before the Fed makes such a reversal, the S&P500 could lose 7 to 12% from current levels near 3600 (200-week average) and 3400 (pre-pandemic peak).

It is challenging to find meaningful technical levels for the dollar index down to the 120 area, which could take up to five months if the momentum gained since the beginning of the year is maintained.

The FxPro Analyst Team