The big central bank week continues. Following the Fed yesterday, the Swiss National Bank left its policy unchanged and now the markets’ attention is turning to comments and signals from the Bank of England.

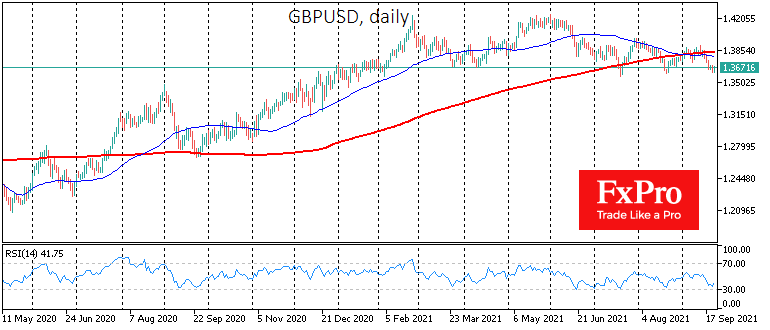

Market participants will assess the chances and timing of further central bank moves, which will affect the Pound and stock market dynamics. The GBPUSD is now near the lower end of the trading range of the last eight months, and the Bank of England’s measured approach may sharply increase the selling of the Pound, pushing it beyond its settled range, creating the potential for a decline as low as 1.3000 before the end of the year. But it also promises to boost the FTSE100, which is having difficulties with sustained gains above 7100. The Bank of England’s dovish stance would open a direct route for the index to rise to 7500 by the end of the year.

Should the unwinding of the stimulus and the drive for policy normalisation prove to be faster than expected, the Pound would again remain within a range of 1.36-1.42, heading towards its upper boundary. At the same time, the FTSE100 might go into a deeper correction towards 6800.

The FxPro Analyst Team