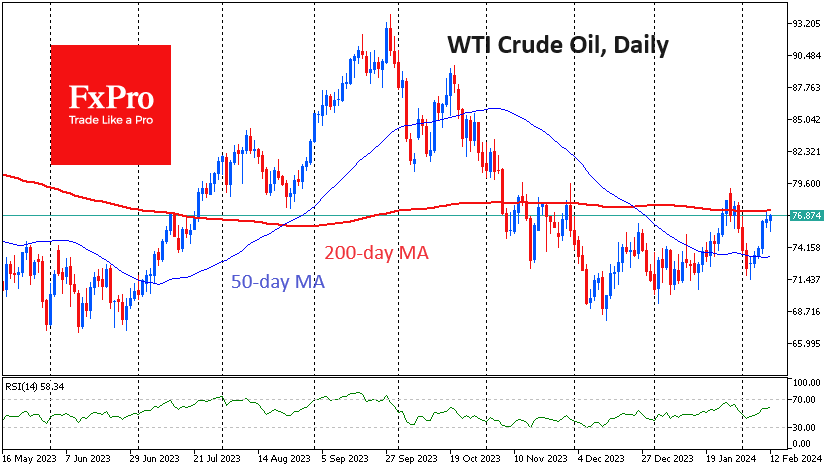

Oil went on the offensive last week, once again confirming the importance of support at the 200-week moving average. Both robust US economic data and OPEC+ intentions to keep production under control fuelled the rally. All this is on top of growing supply issues across the Red Sea.

Oil is currently undergoing a crucial technical test in the form of the 50-week and almost synchronised 200-day moving averages. This area has acted as significant resistance over the past three months.

A break above the 200-day would mark a significant shift in trader and investor sentiment, potentially paving the way for more active buying. Failure to do so could be followed by a relatively smooth fall to $72 for WTI and $75 for Brent.

The FxPro Analyst Team