As is often the case, markets find themselves at important turning points ahead of significant scheduled events. One of the latter is the Monetary Policy Symposium in Jackson Hole, which starts later this week. This resort’s signs could break the Dollar’s rise or accelerate it by removing the final obstacle.

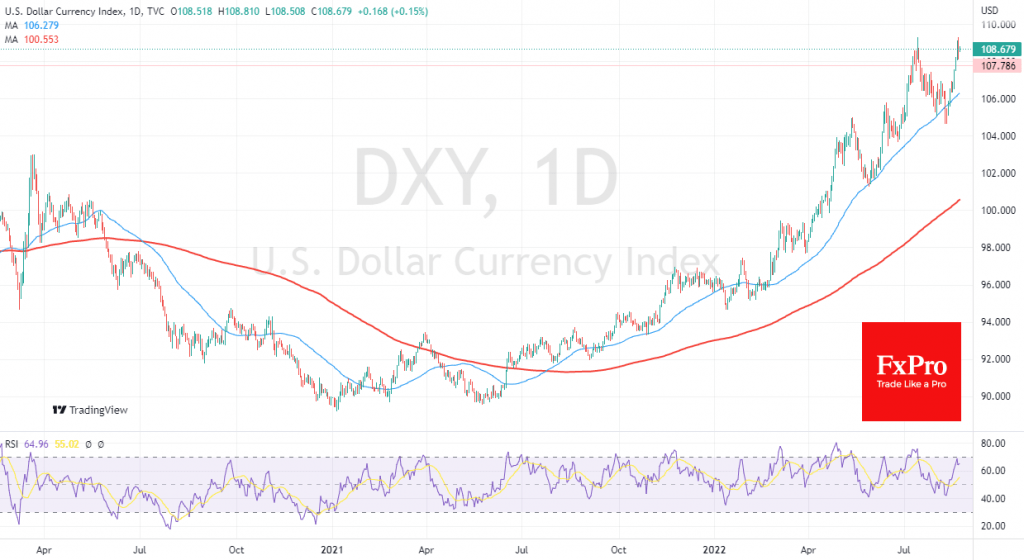

In FX, the Dollar index made a 20-year high above 109.2 earlier in the week and then we saw some profit-taking activity, which caused the Dollar to slide around 1% against a basket of major peers.

How the Dollar will close this week likely determines the dynamics for the next few months.

Fed officials have spent the last couple of weeks actively managing expectations, indicating that the central bank has a more hawkish approach to policy, denying the problems in the economy that investors so fear. Traders in the markets are speculating whether this means the risk of a third consecutive rate hike of 75 points in September.

In our view, the higher odds are that the Fed is leading exactly to that scenario and Powell’s comments will proclaim the ultimate victory of that scenario. The hawks have a strong labour market and the need to anchor inflation expectations on their side.

In this scenario, the dollar index is moving towards 120 (+10.5% to the current price), which is at its 2001-2002 highs. It is likely that on the approach to these levels, even the hawkish Fed and Treasury are concerned about a strong dollar. After all, along with lower inflation and faith in the main reserve currency, the world will get “side effects” in the form of extreme financial market volatility and a sharp slowdown of the global economy, which is also not in the interests of the USA.

An alternative scenario is that Powell has probably learned his lesson from 2018 and is now paying more attention to signals from the market. Back then, four years ago, he was pushing the idea of further rate hikes, which scared the markets. The S&P500 then fell almost 20% from its peak, touching its 200-week average at one point. Near those levels, Powell got softer, and just over six months later, he cut rates altogether.

If Powell and Co. have concluded this story, they will pay more attention to market sentiment. In that case, the markets will hear another batch of vague promises, leaving all doors open for the committee on the next monetary policy steps.

Confirmation that the Fed is easing its pressure on the markets will form a double top in the DXY and reverse towards 103.7 – the 2020 peak. However, we cannot rule out that this will be the start of a longer and deeper dollar pullback.

The FxPro Analyst Team