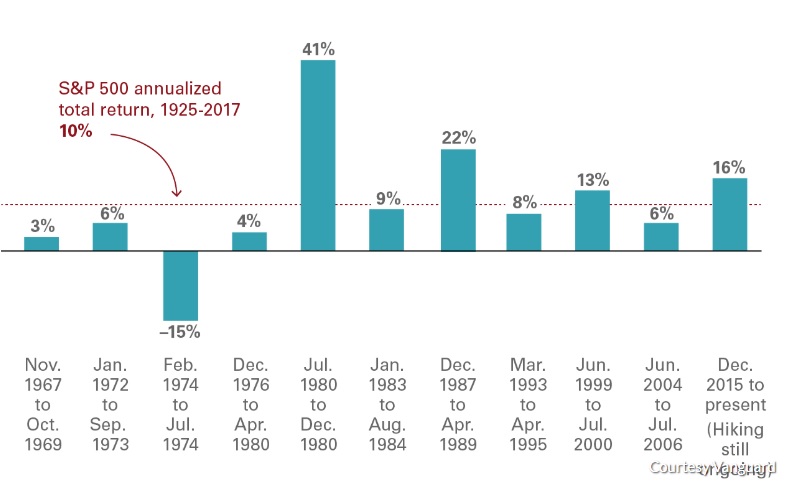

The U.S. Federal Reserve is widely expected to raise interest rates on Wednesday, the latest step in a changing environment for monetary policy that has some stock investors on edge. History, however, suggests that rising rates aren’t the kind of headwind some investors may be thinking. According to Vanguard, periods of rising rates almost always coincide with market gains, even if the move higher in stocks is typically modest. The asset-managing giant looked at data covering the past 50 years, which included 11 periods where the Fed raised rates. The market rose in 10 of the 11 periods, as seen in the following chart.

According to Vanguard’s data, the market sees an annualized total return of about 10.3% over the periods, on average. However, that average is skewed by the 41% return in 1980. For all years, not just those with rising rates, Vanguard said the annualized average gain is 10%. In seven of the 11 periods, rising-rate environments coincided with gains that were smaller than that.

Joseph Davis, Vanguard’s chief economist noted this might be counterintuitive, as “many investors believe that rising interest rates are a harbinger of poor stock returns,” adding that “they have some solid reasons for thinking that,” including that higher rates make bonds relatively more attractive, and that they can slow overall economic growth, a headwind for corporate profits. “Financially savvy investors might also note that higher interest rates lower the value of future corporate earnings, thereby reducing their present value,” he added.

The Federal Open Market Committee begins a two-day meeting on Tuesday, and the U.S. central bank will announce any policy changes on Wednesday, while Fed Chairman Jerome Powell is scheduled to give a press conference. Davis said it was “all but certain” that the Fed would raise short-term interest rates by 25 basis points, lifting them to a range of 2% to 2.25%, which would be their highest level in a decade.

The Fed has been steadily raising rates to keep the U.S. from growing so fast that inflation gets out of hand. There’s more of a danger of that now, even if just a small one, with the economy expanding at a rapid pace and inflation hitting the highest level in six years.