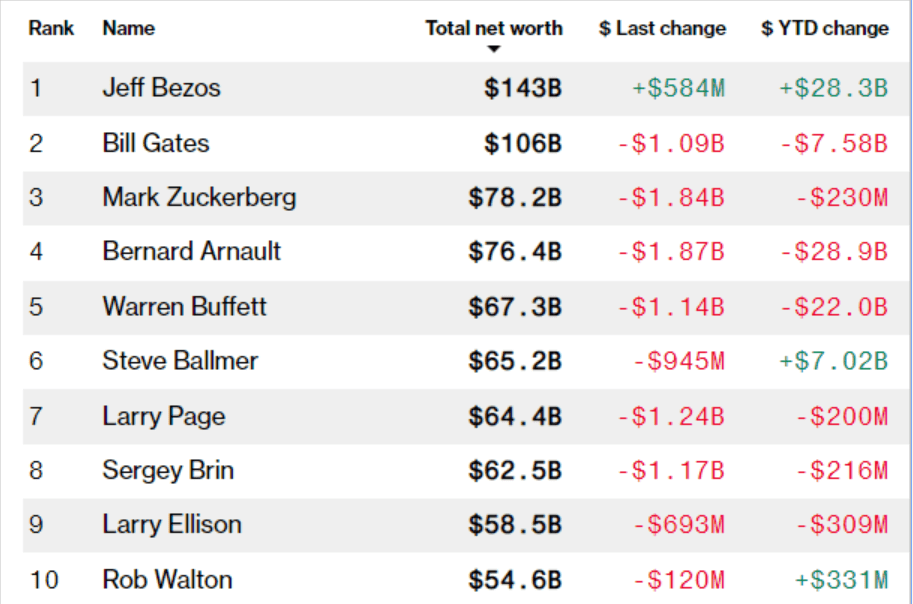

The current Bloomberg wealth rankings have just given critics of Warren Buffett more fodder. As of May 14, Facebook founder and CEO Mark Zuckerberg is worth $78.2 billion. He is now the world’s third-richest person. Warren Buffett’s wealth, on the other hand, now stands at $67.3 billion. He is currently the world’s fifth-richest billionaire.

With a drop to the fifth position, Buffett will attract more ire from critics who are growing weary of his value-investing strategy. There’s nothing to be learned from Mark Zuckerberg’s rise to the position of the world’s third-richest person. All he did was not lose more than Warren Buffett!

In less than five months, Buffett’s wealth has fallen by $22 billion, while Zuckerberg’s value has only declined by a tiny fraction of that amount. At the start of the year, Buffet was worth $89.3 billion, while Zuckerberg was worth $78.4 billion.

The difference is due to the nature of the businesses the two billionaires are in as the coronavirus crisis unfolded. So far, Facebook’s business has barely been affected by the pandemic, managing to record increased usage and revenue. Berkshire Hathaway, on the other hand, owns or owned significant stakes in businesses that have suffered from the coronavirus-induced demand shock. This includes oil and airline stocks. The investing conglomerate is also heavily exposed to financial stocks, which have also taken a beating as interest rates fall.

Facebook’s most recent quarterly earnings report suggests it will weather the coronavirus storm relatively unscathed. In Q1 2020, Facebook saw an increase in users, revenue, and net income.

Compared to the first quarter of 2019, revenues went up around 18%, while net income more than doubled. Usage grew over 10% across various categories.

Consequently, Facebook’s stock has remained mostly unaffected by the coronavirus pandemic and has lost less than a percentage point since the start of the year.

Berkshire Hathaway, on the other hand, has fared poorly since COVID-19 hit. In the first quarter, the investing conglomerate reported an unrealized loss of $50 billion. This was mainly due to a fall in equity values in its portfolio.

The rise of Mark Zuckerberg and the fall of Warren Buffett comes at a time when the Oracle of Omaha is facing scrutiny over his investing style.

Why Mark Zuckerberg Is Now Richer than Warren Buffett, CCN, May 14