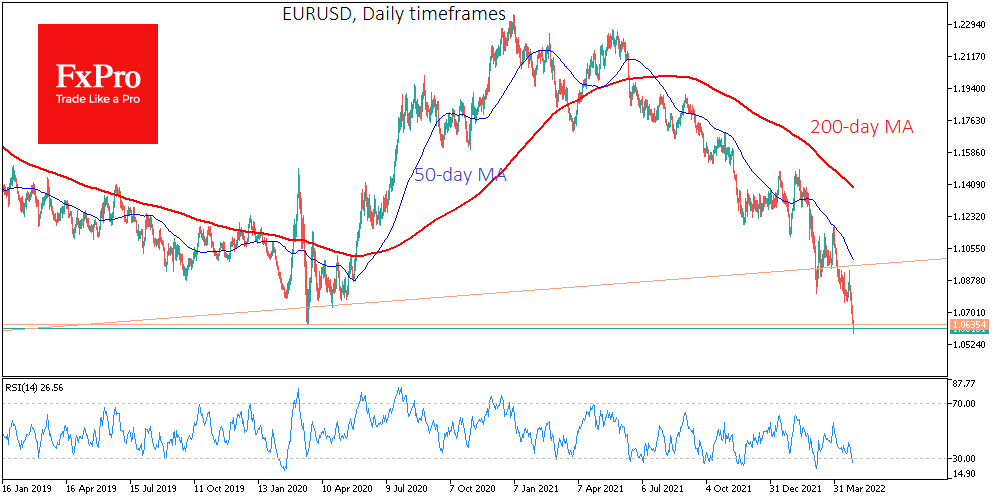

The single currency has fallen under 1.0590, below pandemic lows and at its lowest level since April 2017. The 1.0600 area for EURUSD has repeatedly worked as a turning point since 2015. In 1997 and 1998 the selloffs also stopped at this level. And in late 1999, a move below 1.06 after a prolonged consolidation was the start of a 20% failure in the pair.

Thus, the EURUSD has reached one of its most important historical milestones, even more important than the euro/dollar parity.

And there are now increasing signs that the next steps for EURUSD will be more of a repeat of 1999 than 2017 or 2020.

On the monthly charts, the EURUSD is consolidating below the ultra-long term uptrend line dating back to 1971, including passing near the lows of 2000-2002, 2016 and 2020. We could see a furious selloff in the single currency without a sharp rebound in the pair over the next couple of weeks.

On the sellers’ side, there is a sharply slipping economic mood. A new survey by Germany’s GfK noted the worst consumer sentiment in history, even worse than at the lowest point of the pandemic.

Consumers are reducing their income expectations and sharply increasing their propensity to save. This consumer sentiment works against economic recovery as it reduces consumer spending and hence corporate and government revenues.

Potentially for the debt-burdened Eurozone, this is a bad sign because the currency’s weakness leads to higher bond yields and makes debt service even more expensive. This is especially true for Greece and Italy, and several other countries.

Potentially, a fixation of EURUSD below 1.0600 could trigger a true Euro capitulation with potential targets at 0.9700 and a more distant target at 0.8500 in 2023.

The FxPro Analyst Team