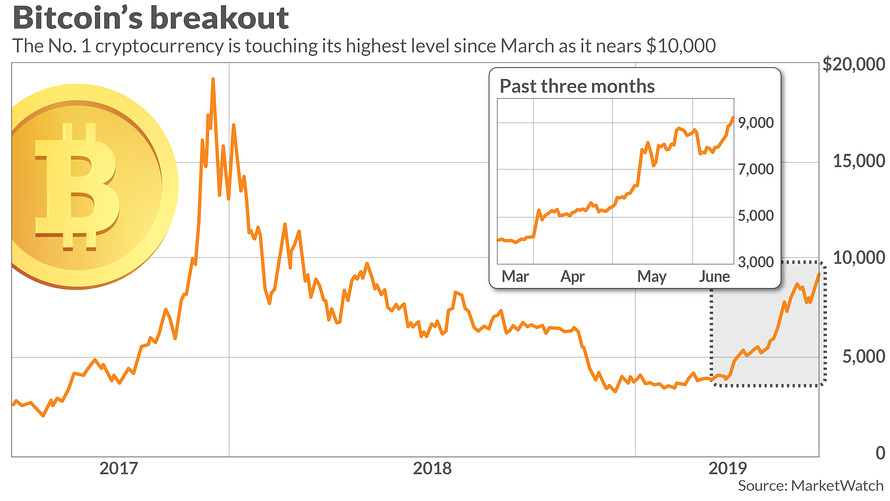

Bitcoin is back! The world’s No. 1 cryptocurrency is on fire, with a price approaching $10,000, pushing the digital asset near its highest level in more than 14 months, according to MarketWatch data provided by CoinDesk.

A single bitcoin BTCUSD, -0.72% most recently, was trading at $9, 218.21, after putting in a December low at $3,194.96. Its current level is bitcoin’s loftiest level since March 29, 2018 when a bitcoin changed hands above $9,700.

Moreover, bitcoin trading on the CME Group’s futures exchange for June delivery BTCM19, -1.12% was at $9,265, up 9.7% on the day, representing a 153% surge for bitcoin futures for the year to date.

Growing interest

Trading of bitcoin has been climbing, as reflected in futures activity on CME Group. Over the past several weeks bitcoin futures trading activity, gauged by its moving average since inception of bitcoin trading is at a record (see chart below).

Facebook’s libra

Reports that Facebook Inc. FB, +4.24% is about to roll out a cryptocurrency as soon as Tuesday has helped bitcoin to notch its best weekly trading period in about three weeks. The social-media giant will unveil a new crypto-payment platform that could facilitate digital payments not just on Facebook’s site but anywhere on the internet. Participants reportedly include an array of heavyweight backers, like Mastercard Inc., PayPal Holdings Inc., UberTechnologies and Visa Inc.

Ripple effect?

Shares of MoneyGram International Inc. soared late-Monday after Ripple Inc., a blockchain startup behind the XRP coin agreed to invest up to $50 million in the money-transfer company, marking another powerful event for cyptos.