Asian currencies are enjoying steady investor demand, continuing to rise against the dollar. European currencies are showing a more modest strengthening, mainly remaining within established trading ranges.

The division between currency market leaders and outsiders now seems to be based on fundamental factors. The ranking of currencies appears to be hinging on the real yield of the debt market, i.e. the difference between bond yield and inflation.

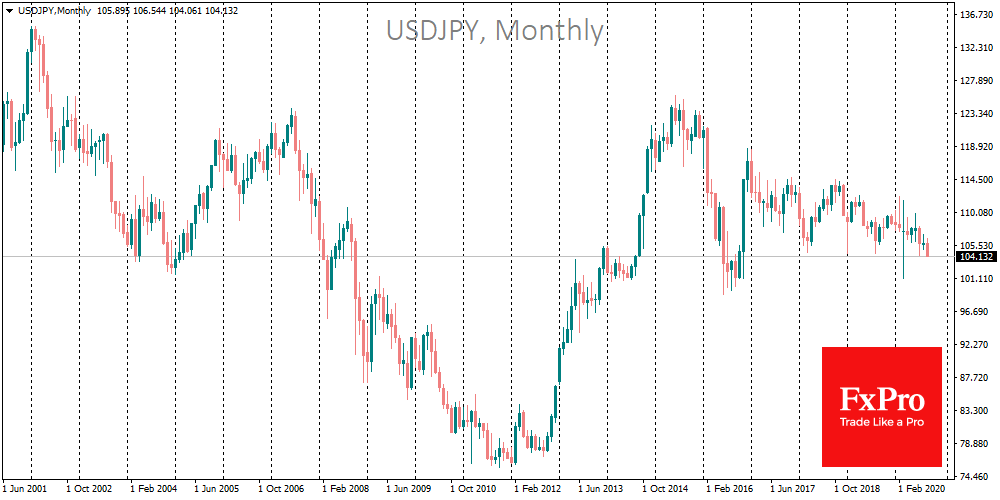

Investors are already accustomed to chronically low inflation in Japan and see that the country’s central bank cannot break it up despite Quantitative and Qualitative Easing being held for years. Its impact has been largely reflected in market expectations and financial instrument quotes. However, at the start, the yen experienced a serious slump.

The launch of QQE almost coincided with a reversal from a multi-year low of 76 yen to the dollar and took 4 years for the pair take off above 120.

The situation is slightly different in the US, where the Federal Reserve recently in late August announced a change of strategy for monetary policy. However, as early as March, the FOMC has launched several robust programmes that have turned the US currency towards decline.

The official change in strategy cemented changes that the Fed had already de facto resorted to. For investors in dollars, this could also be the start of a multi-year trend, as it was for the yen.

Although the American currency is fighting the euro and the pound without falling above key levels, very soon corrective kickbacks will start. For example, EURUSD fell below 1.1750 at the beginning of last week, but during the day the pair was bought back, closing the day with an increase.

The pound vs the dollar bounced back from its 200-day average, also receiving an influx of buyers.

However, Britain often copies the Fed’s strategy, so the pound also runs the risk of being under pressure. Investors in European assets are afraid of this, which explains the leading position of the yen in recent days.

For JPY, infinite QE is a known evil that has long been taken into account by the market. At the same time, policy from the Fed, ECB and Bank of England risks generating powerful currents that could affect currency rates in the coming years.

The dollar and the pound could potentially be the main victims, as central banks in these countries could resort more heavily to negative real rate policies to reduced debt in nominal terms while increasing export competitiveness through exchange rate depreciation.

The FxPro Analyst Team