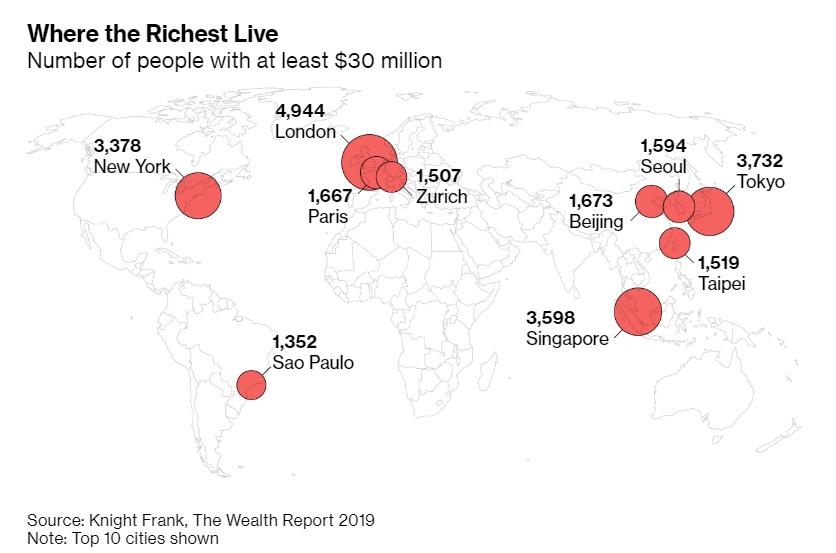

With their private jets and multiple houses, the world’s mega-rich are the ultimate globetrotters. Yet about half of this elite population have their main residences within a group of just 10 cities, according to Knight Frank’s 2019 Wealth Report, which lists London, Tokyo and Singapore as home to the most people worth at least $30 million. Although the U.S. is the world’s largest economy, New York is its only city in the real estate brokerage’s top 10.

The data highlight the concentration of the ultra-wealthy living in the biggest metropolises. Business opportunities, lifestyle desires, hospitals and transportation infrastructure are all factors that draw the super-rich to splash out on homes in large cities. That’s especially true with London — the U.K.’s political and financial center, and the world’s top wealth hub — where foreign property buyers have faced criticism for pushing up prices. London’s richest include members of the billionaire Rausing family, who own packaging company Tetra Laval, and Chelsea neighborhood landowner Charles Cadogan.

The world had almost 200,000 ultra-high-net worth individuals last year, according to the broker’s wealth study, with more than two-thirds of them across Asia, Europe and North America. Europe is the biggest regional center for this population globally, while the surge among Asian economies means the world will have more than 20 million people worth at least $1 million for the first time this year.

Asia’s economic growth is boosting luxury investments worldwide. Last year, China and Hong Kong buyers accounted for about a quarter of purchases in London homes worth at least 2 million pounds ($2.6 million), according to Knight Frank, almost doubling from two years earlier. The region’s rich also boosted demand for luxury collectibles, helping push the broker’s Rare Whisky 100 Index up 40 percent last year.

Here’s Where to Find the World’s Super Rich, From Paris to Tokyo, Bloomberg, Mar 06