The EURUSD has been hovering around 1.05 for the fourth day in a row, which is the last round level point before moving towards parity. This lull could be interpreted as an attempt by the bears to gain strength before a new decline, or it could indicate that the downside momentum is exhausted.

History and fundamentals suggest that a further downside move after a pause is more likely for now.

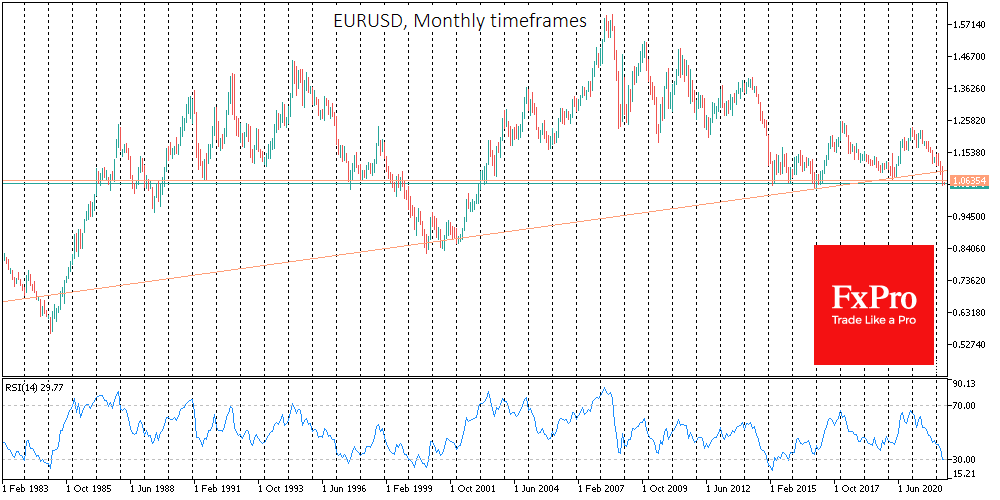

EURUSD looks oversold by the RSI on the high timeframes above one day. However, history suggests that this oversold pattern appears in this pair at times of historical outlook reassessment, which is well within the current framework.

The EURUSD has fallen for another four months since the Relative Strength Index touched 30 in 2014. It took more than two years for the pair to recover from the bottom.

In 2000 it took nine months to reach the bottom, and it took 25 months before the reversal began.

The EURUSD (assembled from the predecessor currencies to the euro) had an even more pessimistic history in the first half of the 1980s. It took nearly five years after first touching oversold in the monthly timeframes and reaching the bottom before reversing.

The reversal to the upside may be much quicker this time, but investors and traders should not lose sight of a very troubling historical observation.

A consolidation of the single currency below 1.05 would cement a break of the seven-year support area. This may be the first step towards the lows of 2000-2002, at 0.8200-0.8500.

The bulls’ ability to defend long-term support could inspire more buyers, sending EURUSD above 1.2200 as it did in 1998, 2017 and 2020.

The FxPro Analyst Team