Gold has shed its position for the second day in a row, losing more than 1% during that time, and that might be just the beginning of a new downside wave, which will potentially take the price down to $1650. However, investors and traders will likely consider the potential to outweigh the risks early on.

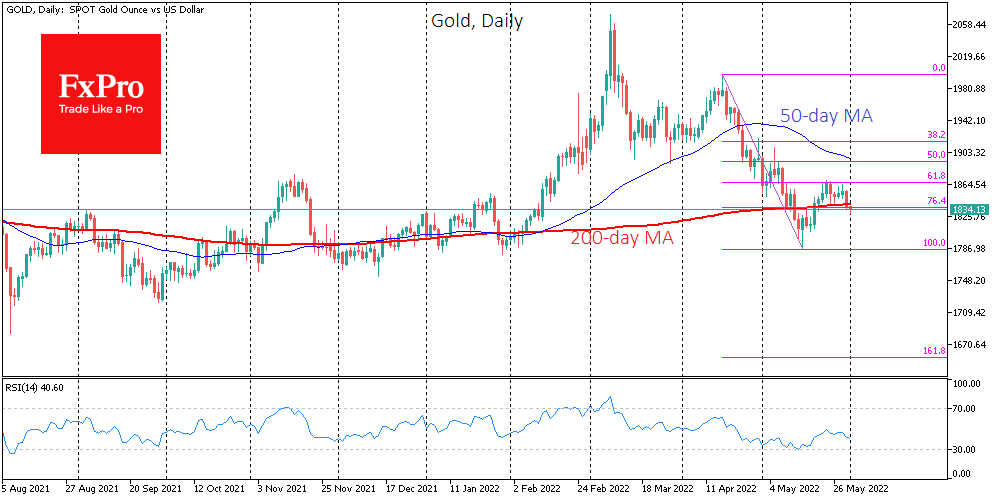

The momentum of the ounce’s decline from April 18 to May 16 took more than $200 from the peak to the bottom and was sharp enough for the bears to need a recharge. However, at the beginning of last week, the rebound began to choke around 61.8% of the initial rally – clearly within the Fibonacci pattern.

Yesterday Gold closed below its 200 SMA, and the debt and equity markets went back to selling. This dynamic is a significant signal that the bounce and consolidation phase ends in a victory for the dollar bulls, which increases the pressure on gold.

By Fibonacci, the final selling point, in that case, would be the 161.8% level of the initial momentum, somewhere around $1650, where the price was by the end of February 2020. That is, before the spike, the subsequent failure, and a long pandemic rally.

Such a scenario would be very nice, but several factors could prevent it from materialising. Gold has been repeatedly redeemed on dips to the $1750 area in the past year. Inflationary acceleration and geopolitics gradually raised the bar from which purchases prevailed.

There is also a $1750 mark near 61.8% from the 2018-2020 rally, and the bulls can step up the onslaught at the top defence level. If they fail to do so, there could be an absolute capitulation in gold.

The entire decline path can be broken down into several phases. Initially, the bears need to break support at $1780, the previous local lows. Next, the decline may encounter support from more principled buyers in $1740-1750. If the sellers are stronger here, gold could fall back to $1650 before the end of August.

The FxPro Analyst Team