In the upcoming week, focus will shift back to monetary policy, with key interest rate decisions expected from both the Federal Reserve and the Bank of England.

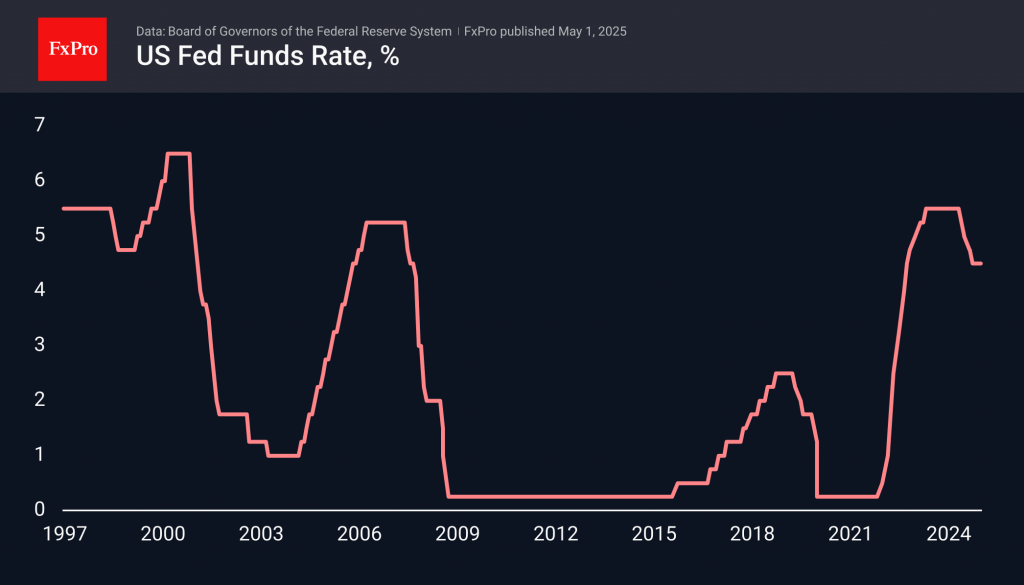

On Wednesday, Powell and Сo are expected to keep the key rate unchanged, but the intrigue is all about signalling how soon to expect policy easing. The main obstacles are extremely high inflation expectations and forecasts of real price rises due to tariffs.

The Bank of England is set to announce its policy decision on Thursday, with markets anticipating a fourth rate cut in the current cycle — bringing the benchmark rate down to 4.25% from the current 4.5%. While the fate of the US tariffs creates the same uncertainty for everyone, it still manifests itself in the form of inflation in the US and economic pressure in the rest of the world. Hence, Europe’s response is to cut rates.

Friday’s Canadian labour market data will be key to assessing the impact of U.S. tariffs on its trading partners. While employment growth is forecast at 22,000, the potential for significant surprises remains.

The FxPro Analyst Team