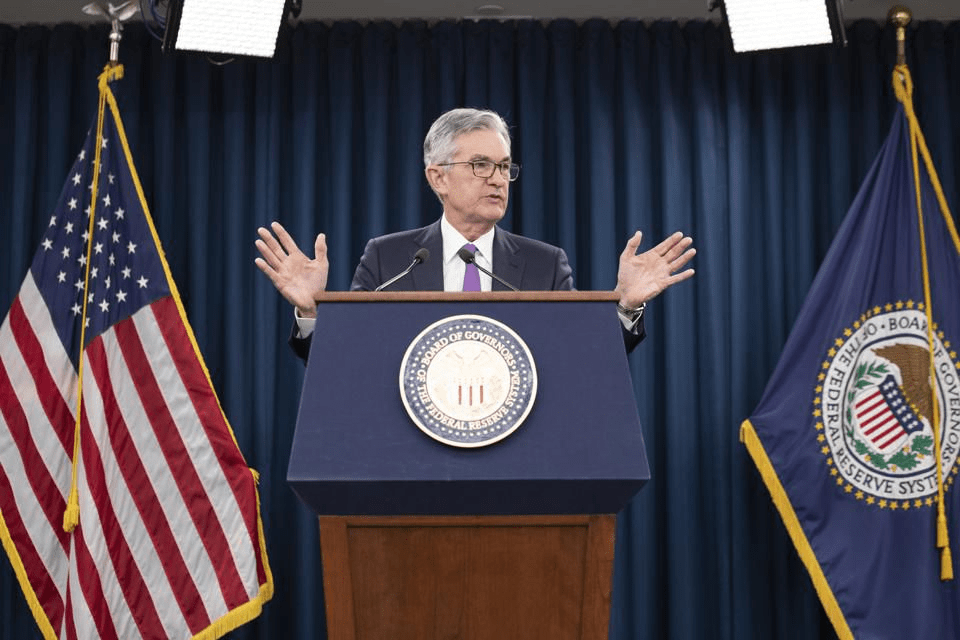

Tuesday will mark the first of two days of meetings for the Federal Open Market Committee. The Federal Reserve will release its September monetary policy statement Wednesday afternoon, followed by a press conference with Fed Chair Jerome Powell. Both the statement and remarks are expected to reaffirm policymakers’ cautious tone on economic growth during the pandemic, and potentially lay the groundwork for more specifics on the central bank’s plan for forward guidance, following its newly announced policy framework around inflation announced at its annual symposium in late August.

“Given we just got a significant update from Fed Chair Powell at the annual Jackson Hole Symposium, the upcoming meeting should garner much less fanfare than usual,” RBC Capital Markets economists wrote in a note Friday. “Most of what Powell touched on at Jackson Hole was very forward-guidance driven. So we will hear about 1) more willingness to let inflation run above 2% (the inflation averaging provisions) and 2) letting the unemployment rate drift well below the natural rate in the future (the de-linking of employment and inflation that Powell promoted).” “From our lens the recent tweaks are merely a concretization of an already active process,” they added.

The three major indices each closed more than 1% higher, and the Nasdaq rose for the first time in three sessions as tech stocks shook off last week’s jitters. Apple (AAPL) shares gained 3% and added to gains in late trading, paring some declines after losing 4.5% over the two sessions prior. The company is set to hold a virtual product launch event Tuesday morning, which is expected to focus on the Apple Watch. Information technology was the second best-performing sector in the S&P 500 on Monday, closely following the real estate sector.

Stock market news live updates: Stock futures open flat, pausing after rally, Yahoo Finance, Sep 15