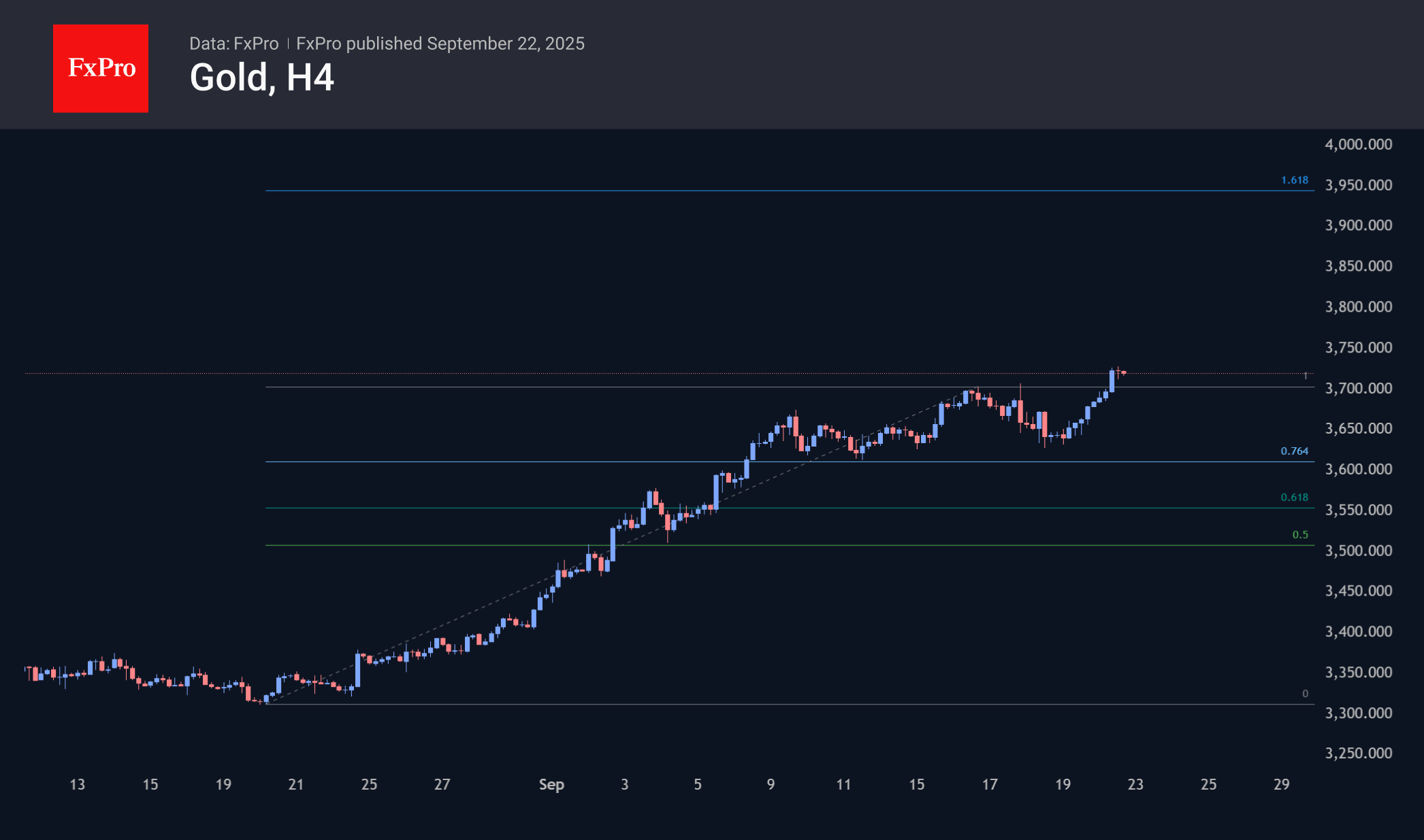

Gold is once again benefiting from a combination of geopolitical tensions, demand for safe-haven assets, and reduced risk appetite in the stock and cryptocurrency markets. The price per ounce returned to its historic highs, reaching $3,750 on the spot market and adding 3% from the start of the day on Friday to the start of active trading in Europe on Tuesday.

The previous historic high was set on 17 September, followed by two days of profit-taking. However, the wave of decline was not long-lasting, and gold corrected by less than 20% from its last rally on 20 August. This indicates a strong appetite for gold, despite the price highs and an almost unprecedented rate of growth since the beginning of the year. From a technical point of view, the expansion of this pattern indicates the potential for the price to rise to $4,000.

Politics is once again working in favour of gold bugs. The tightening of work visa rules is likely to cause discontent in India. Modi’s statements about the need to make the country independent of foreign markets are undermining hopes for a trade settlement.

The latest discussion of a government shutdown also supports gold purchases.

The Fed’s softening of its monetary policy stance is providing additional long-term confidence to buyers. Although this reassessment of market prospects has paused in recent days, it appears to be a pause rather than a reversal, as it would take a strong improvement in labour market indicators and a surge in inflation to change this trend.

Gold is being pushed in the same direction by expectations that global central banks will continue to accumulate gold reserves at the expense of the dollar’s share in them, as alternative currencies do not look much better in terms of fundamentals.

On the other hand, the price growth rate is now more of a bearish factor. The historic rally is increasing demand for a full-fledged portfolio shake-up, with a correction of more than 130% growth over the last three years. The period from September to November, with the end of the financial and calendar year, looks like a suitable point to start this trend.

Additionally, the RSI on daily timeframes entering the overbought zone above 80 earlier in September increases the risks of a decline. Last week’s price decline pushed the index back to 70. A similar signal has triggered a sideways movement or correction about a dozen times in the last five years, with only one exception in April 2024, when we saw an 8% price increase before a three-month sideways movement.

On balance, we view the situation as the final stage of gold’s increase over the past three years. Growth within it may be quite aggressive, combined with accelerated closing of short positions. However, for medium- and long-term investors, this is suitable for closing long positions and looking for the right moment to open short ones.

The FxPro Analyst Team