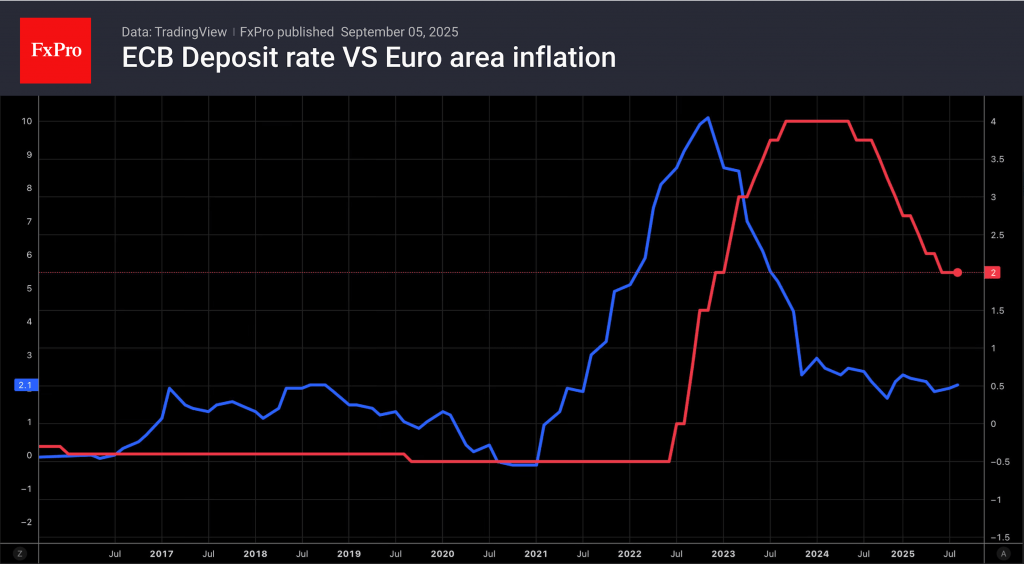

The key events of the second week of September will be the ECB meeting and the publication of US inflation data for August. The European Central Bank is expected to leave its deposit rate at 2%. Nordea predicts that the cycle of monetary expansion is over. This contrasts with the view of Bloomberg experts, whose consensus estimate suggests that another step should be expected in 2025.

Credit Agricole expects the deposit rate to rise by 75 basis points in 12 months, amid an acceleration in the European economy, thanks to fiscal stimulus. Divergence in monetary policy will keep the EURO USD pair on an upward trend.

Investors will listen closely in September to Christine Lagarde’s comments on the situation in the European debt market.

Trading Economics forecasts an increase in consumer price growth in the US from 2.7% to 2.8%. Core inflation will stabilise at 3.1%. The Fed has made it clear that it is more concerned about the labour market. However, the acceleration of CPI may prevent the central bank from cutting rates in the future. On the contrary, a slowdown in inflation will pave the way for aggressive rate cuts, weaken the dollar and allow stock indices and gold to rise.

The FxPro Analyst Team