In the coming week, the key scheduled macroeconomic events include rate decisions in Australia and New Zealand, Canadian inflation data, and Flash PMIs for Europe.

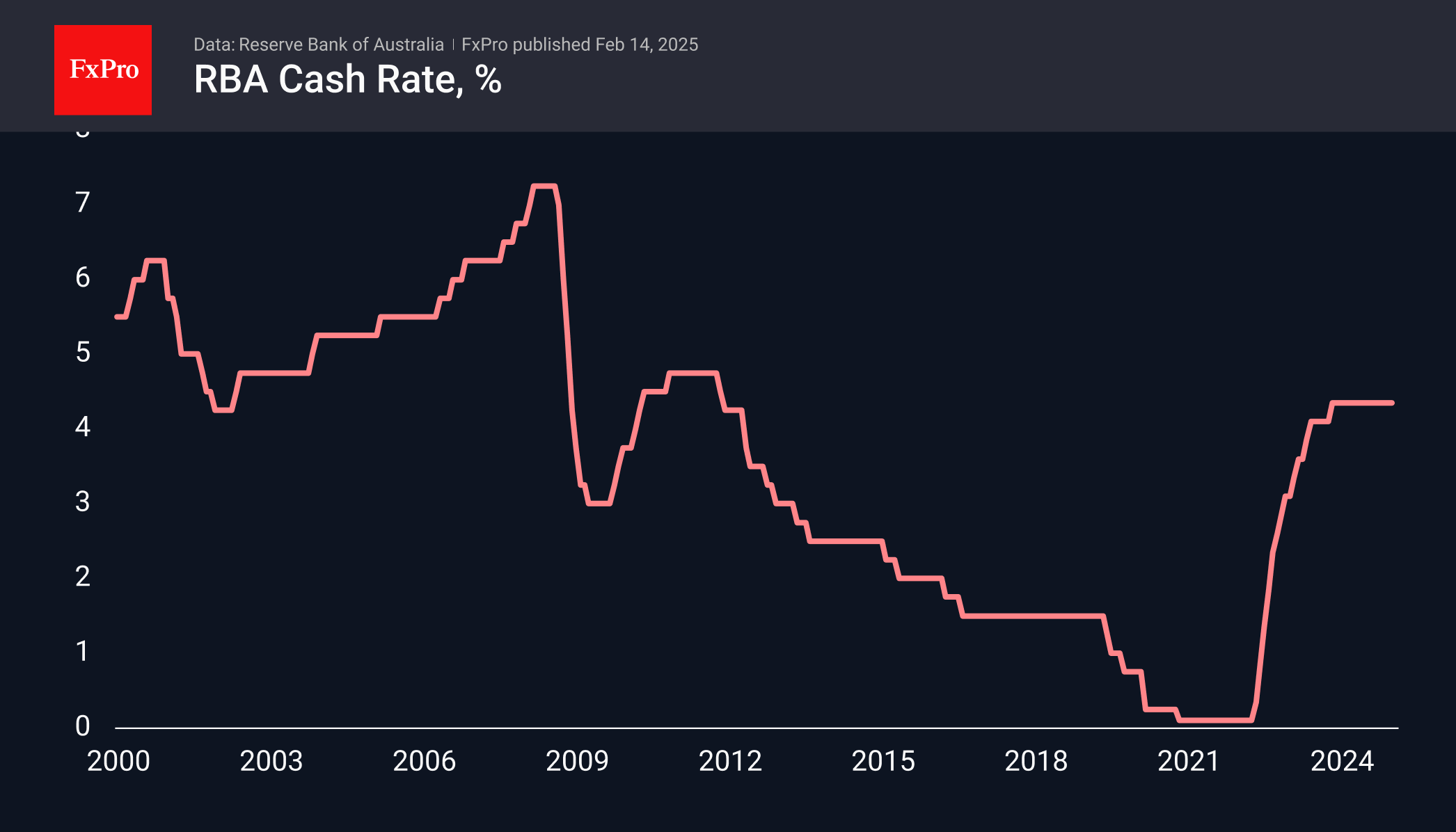

On February 18th, the Reserve Bank of Australia (RBA) is expected to cut the key rate for the first time in this monetary cycle. Australia has been less aggressive in raising rates and is now cutting them somewhat belatedly. The AUDUSD struggled at the end of the year, but the RBA’s decision could significantly impact this trend.

On Tuesday afternoon, Canadian consumer inflation data will be released. Inflation has hovered just above 2% in recent months but may increase due to the depreciating CAD and accelerating US inflation.

The Reserve Bank of New Zealand will announce its rate decision on February 19th. Having already cut rates by 125 basis points, it may choose to pause and assess the economic landscape.

On February 21st, European session trading will be influenced by Flash PMI estimates. Recent data hinted at improving sentiment. Confirmation in the latest batch of data could encourage euro buyers.