The following economic data events are worth paying attention to in the new week.

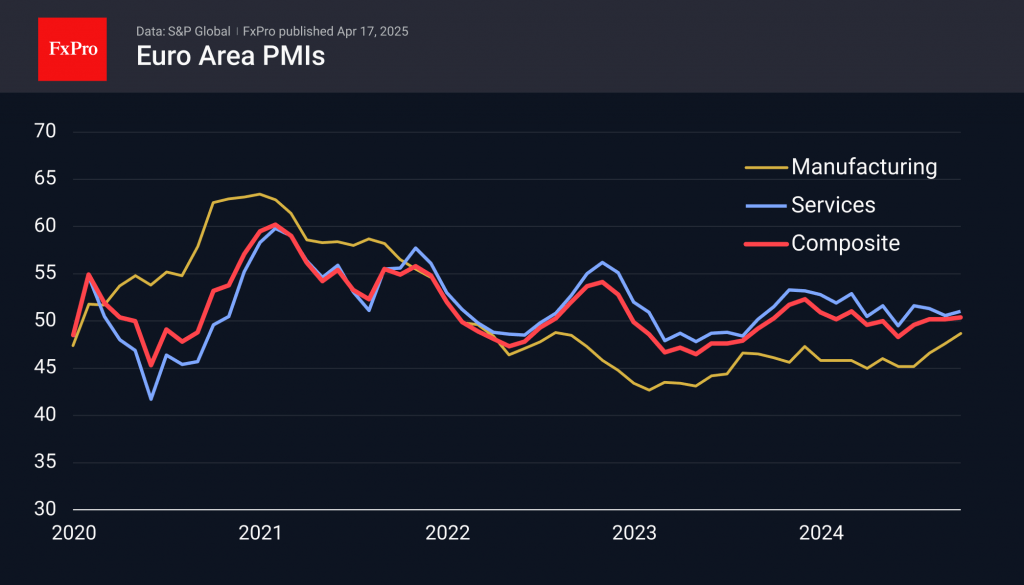

Wednesday will see the release of preliminary PMI estimates for April, which could have a noticeable impact on sentiment on the Euro and European equities. A strong recovery in business activity began in December but could be shattered by tariff fears, as was the case with the ZEW reading for Germany in the outgoing week.

On Thursday, an important piece of the economic puzzle could be the US durable goods orders figures. They have been rising in the previous two months and may accelerate in March, but traders will be looking for signs of a possible peak in the indicator in the near term.