The economic calendar for the week ending 10 October includes Jerome Powell’s speech, the US Government shutdown, postponed statistical releases, and the publication of the FOMC and ECB meetings minutes.

Weak private sector employment data paint a bleak picture and push the Fed towards aggressive monetary policy easing. This is especially true given that the White House has no intention of easing pressure on the central bank. Donald Trump recently posted a cartoon story about the dismissal of the Fed chairman. In this environment, Jerome Powell’s speech could provide investors with important clues.

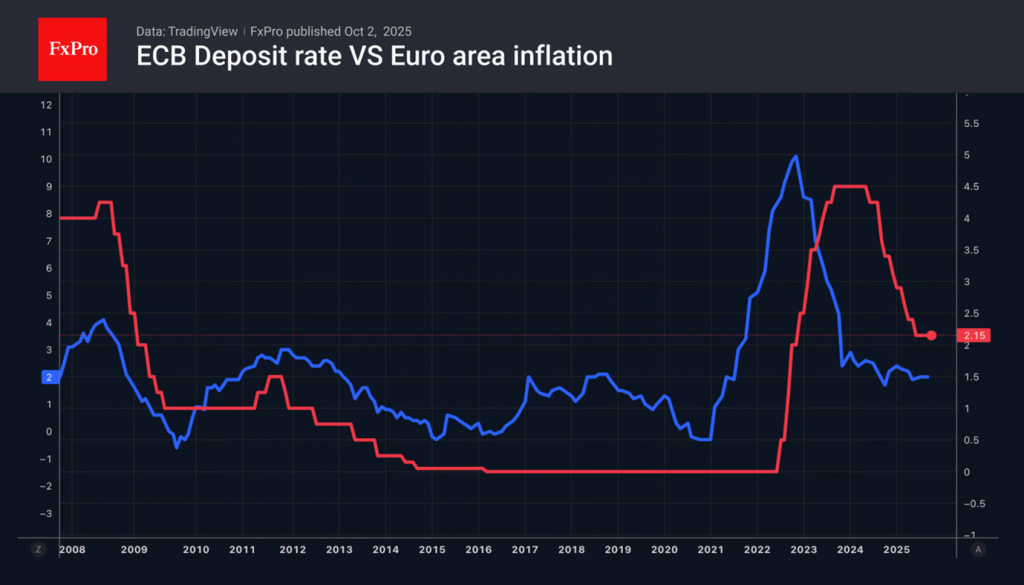

As will the minutes of the meetings of the world’s leading central banks. Top ECB officials, including Philip Lane and Christine Lagarde, argue that the risks of inflation moving in either direction are limited. This allows investors to count on the end of the monetary expansion cycle. For the Fed, it has only just begun. In theory, this divergence should lead to the euro rising against the dollar.

However, the final word will be given by the US labour market report.

The FxPro Analyst Team