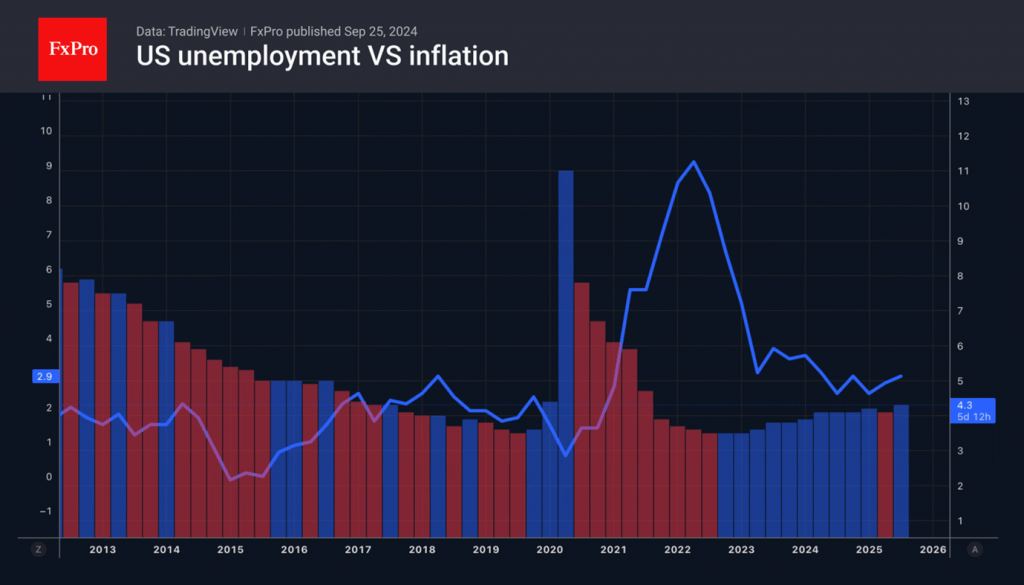

Don’t fight the Fed. The central bank has made it clear that it will closely monitor the labour market situation. It prefers unemployment to inflation, and investors should do the same. In this regard, the US employment report for September is becoming the key event of the week leading up to October 3rd.

After non-farm payrolls slowed from more than 100K in January-March to 29K in June-August, the Fed reasonably lowered the federal funds rate. However, FOMC members are divided on its future. The median forecast suggests a drop from 4.25% to 3.75% by the end of the year. Seven officials do not see any further reduction in the cost of borrowing, while two see the need for only one reduction.

The split within the Fed is forcing investors to look in one direction: the data. First and foremost, labour market statistics. If the market continues to cool, the FOMC’s September forecast will come true, and the dollar and Treasury yields will fall. Conversely, a pleasant surprise from non-farm payrolls could support the greenback.

The FxPro Analyst Team