The highlight of the last full week of June will be Jerome Powell’s testimony before Congress. Investors would like to hear more details about the state of the US economy and the outlook for monetary policy. However, the central bank does not know how and when the armed conflict in the Middle East will end, where Donald Trump’s tariffs will stop, or how they will affect inflation. The Fed is moving in the shadows, and markets need to get used to this.

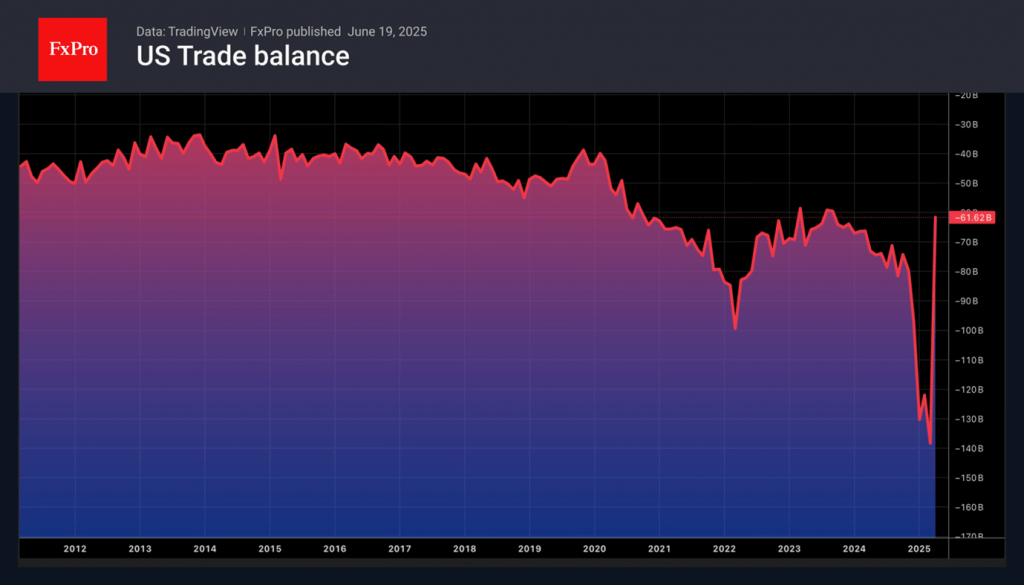

A package of macro statistics, including data on business activity, orders for durable goods, the trade balance, and the personal consumption expenditure index, will help clarify the situation with the US economy. During the holiday season, low trading volumes could trigger serious fluctuations in US stock indices, which will affect other financial markets.

As the 90-day tariff delay expires, trade risks will increase. In theory, this should put pressure on the US dollar. However, it is doubtful that the Israel-Iran conflict will end quickly. Geopolitics is supporting the USD index.

The FxPro Analyst Team