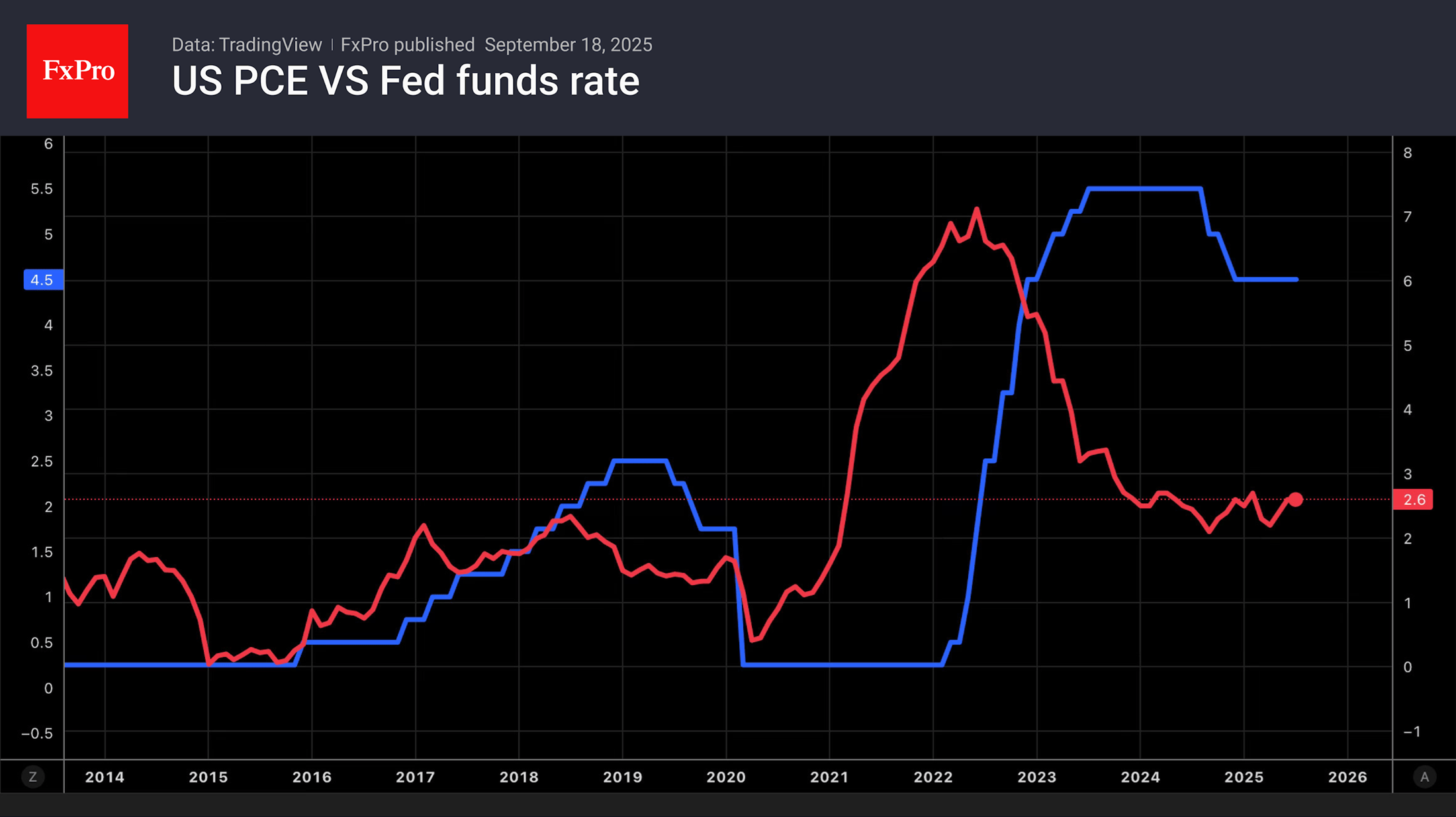

The key economic events for the fourth week of autumn will be the release of data on business activity in various countries around the world and the publication of data on the personal consumption expenditure index, the Fed’s preferred inflation indicator.

So far, the European economy has shown remarkable resilience to Donald Trump’s tariffs. This factor, along with the cooling of the US job market, has been an important driver of the rise of the EURUSD to a four-year high. The latest PMI data could either help or hurt the euro.

Although the Fed has decided to pay more attention to the labour market, accelerating inflation could change the balance of power within the FOMC. There is already a split there. Seven of the 19 members of the Committee do not see any further cuts in the federal funds rate in 2025, while two expect only one cut. Therefore, numerous speeches by Fed representatives in the week leading up to September 26th could seriously shake up the financial markets.

Investors will also continue to monitor geopolitics and the French crisis.

The FxPro Analyst Team