In the last week of October, investors will be focused on US-China trade negotiations and news surrounding Donald Trump’s visit to Asia. The main event on the economic calendar will be the Fed meeting.

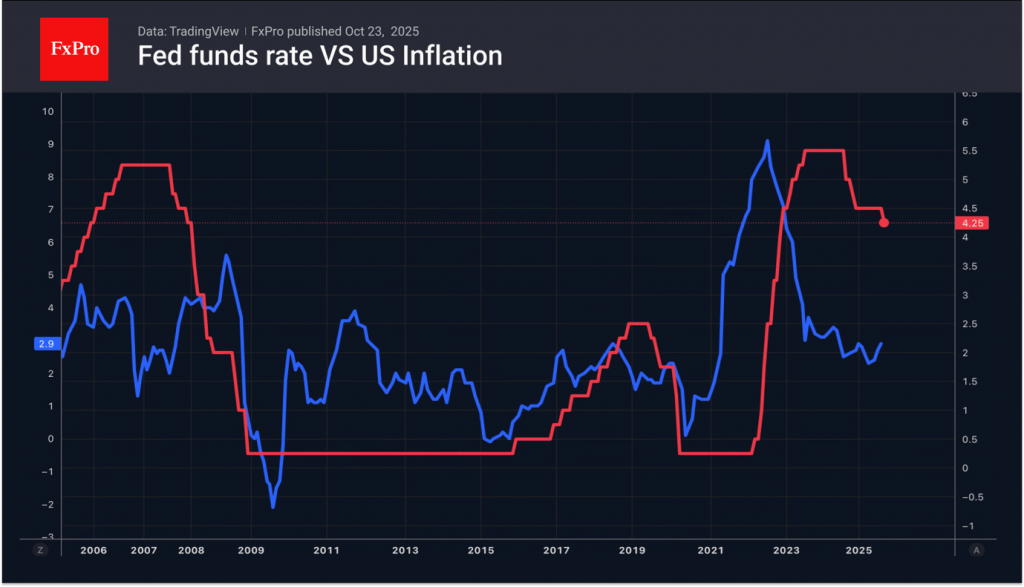

The futures market gives a 97% probability of a cut in the federal funds rate. The chances of another cut in December are estimated at 93%. The Fed is ready to continue despite a lack of data due to the shutdown. However, accelerating inflation could increase the number of hawks. In addition, monetary conditions are very relaxed, and the leading indicator from the Atlanta Fed signals an acceleration of the economy to 3.9% in the third quarter. Is it worth lowering the rate in such conditions?

If Jerome Powell signals a slowdown in the rate-cutting cycle, the dollar may strengthen, and stock indices may fall. This will undoubtedly anger Donald Trump, but the Fed must not allow a repeat of the 1970s. Back then, rampant inflation forced a return to aggressive monetary tightening, which led to a double-dip recession.

The FxPro Analyst Team