The central event of the week leading up to the 22nd of August will be the meeting of central bank governors in Jackson Hole. In the past, regulators have occasionally signalled changes in monetary policy. Now something similar is expected from Jerome Powell. For a long time, the Fed has taken a cautious approach. It has been trying to assess how the White House’s tariffs are affecting inflation and the US economy. The cooling of the labour market from May to July is forcing the Fed to resume its cycle of rate cuts in September.

It may seem that Jerome Powell is yielding to political pressure. President Donald Trump and Treasury Secretary Scott Sussman are calling on the Fed to cut rates aggressively. What will the Fed chairman’s speech in Jackson Hole be like? Financial markets will be watching him closely.

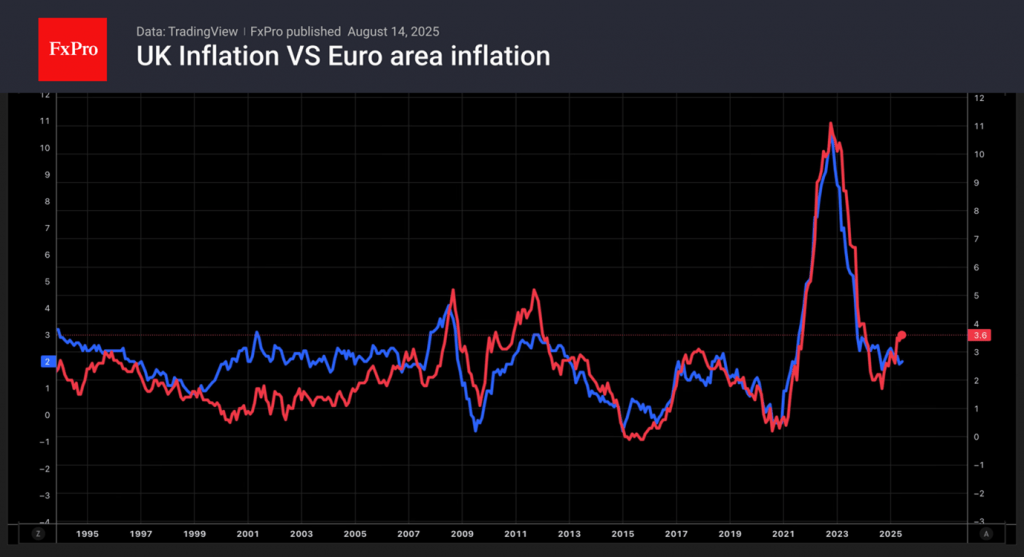

Other events on the economic calendar include British and European inflation statistics and business activity data releases. How resilient will the world’s largest economies be to tariffs? Will import duties drive up consumer prices? These issues are of greater concern to investors than trade policy, where things seem a bit clearer.

The FxPro Analyst Team