The third week of September will be a showcase for central banks. The Federal Reserve, the Bank of Canada, the Bank of England, and the Bank of Japan will announce their decisions on key interest rates. The Fed is expected to resume its monetary easing cycle and signal its continuation for the rest of the year. Donald Trump failed to remove Lisa Cook, who also votes like Jerome Powell, from the FOMC. However, the president’s new nominee, Stephen Muran, has been approved by Congress and will be present. Could this lead to a surprise?

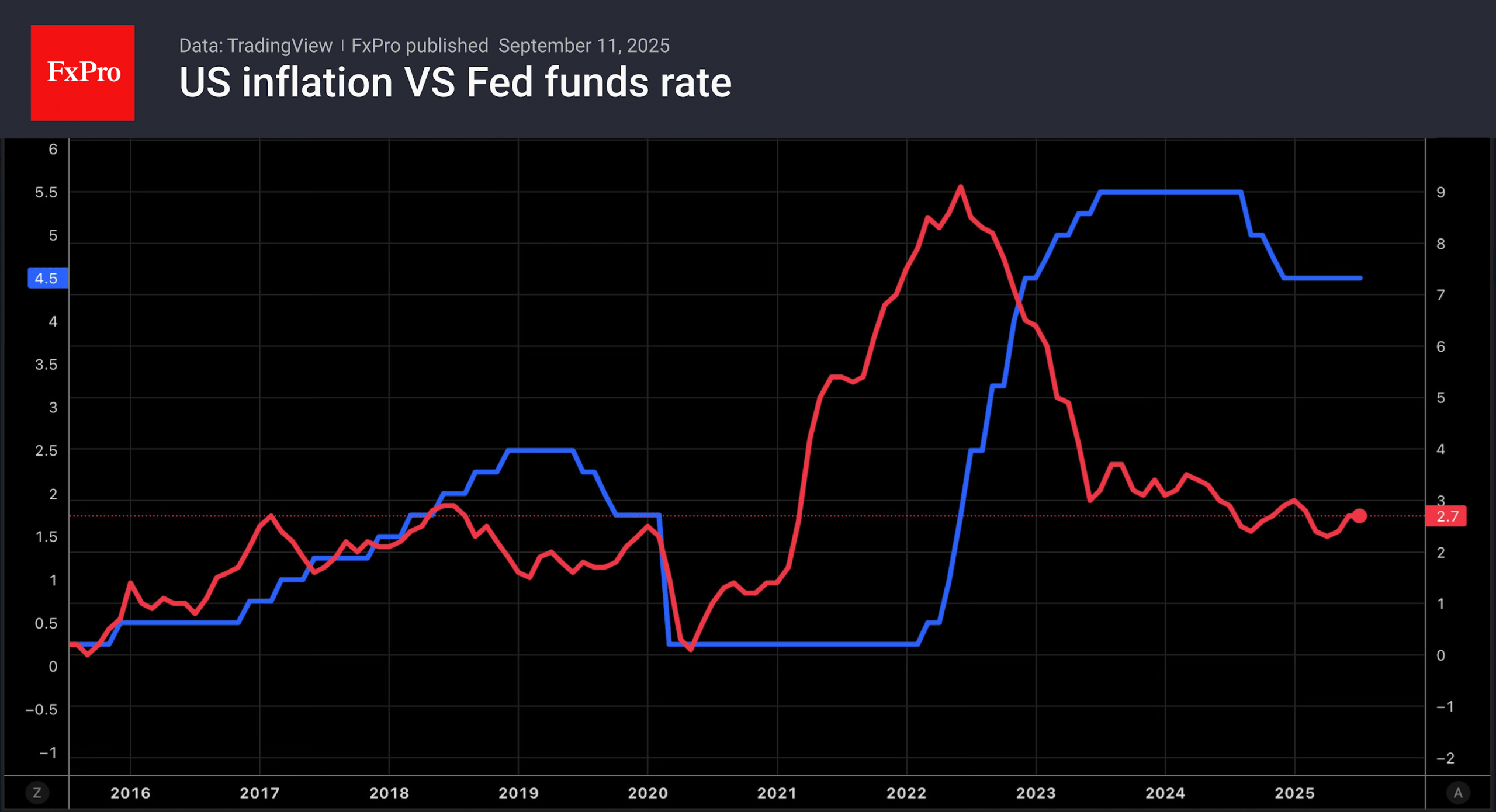

The interest rate futures market is signalling expectations of four rate cuts at the next four meetings. A sharp deterioration in employment estimates and a decline in producer prices allow the Fed to move from expectations to action. Perhaps this is also a direct path to large-scale monetary easing in 2026 after Jerome Powell’s retirement.

This time, the Fed will publish forecasts for key economic indicators and the federal funds rate. Investors will carefully study the updated estimates, which could trigger significant fluctuations in various assets.

The FxPro Analyst Team