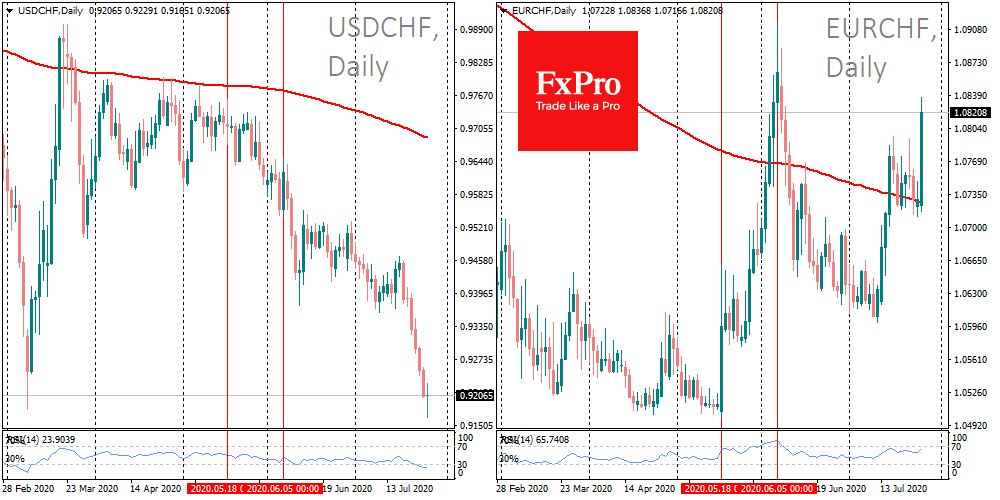

EURUSD has updated its 22-month high, breaking above 1.1760. The growth of the euro can be explained by the influence of the Swiss National Bank. It is trying to weaken the franc, buying mostly euros in its FX reserves. In May-June, the growth of EURCHF passed from the levels of 1.05 to 1.09.

This month the growth has begun from the levels slightly above 1.06 and has already strengthened the euro to 1.0840 francs. However, it will be too straightforward to look only at the dynamics of one pair.

On Monday, the sell-off in USDCHF was stopped at 5-year lows at 0.9165, after which the pair managed to move above 0.9220. The jump in EURCHF in May-June did not lead to an upward reversal in USDCHF.

It cannot be ruled out that the SNB has now set itself a broader goal – to stop the strengthening of the franc against the dollar as well. Indirectly, it also promises to support the euro.

The FxPro Analyst Team