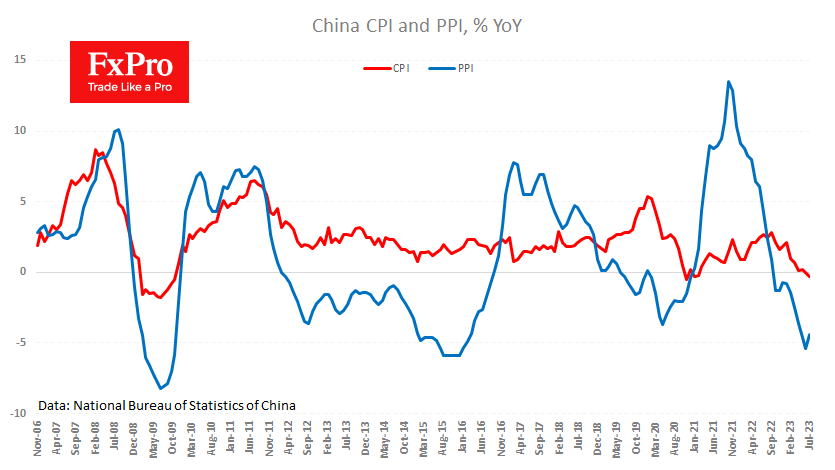

China’s CPI was 0.3% lower year-on-year in July, which the media has rushed to call deflation, while by definition, it is a sustained price fall. It is more accurate to discuss disinflationary pressures caused by one-off factors, including last year’s high base. For example, a 26% fall in pork prices has contributed to the current decline.

Producer prices fell by 4.4% YoY last month, down from 5.4%. A reversal of the upward trend is likely. Of course, much of the downward pressure on prices in recent months has been due to weak demand for goods inside and outside China.

This is to the benefit of global central banks, as the fall in producer prices seen since October in the so-called “world’s factory” is helping to reduce global inflationary pressures. This effect is leveraged by the 7.5% fall in the yuan against the dollar since the start of the year. In such an environment, central banks may continue to receive “good surprises” from inflation reports and stop their hikes sooner than previously thought.

However, questions may arise about whether this is the start of a competitive devaluation as China competes for markets amid the acceleration of other major regional economies, such as India. At the same time, the fall in prices in China does not signal an imminent policy reversal by the Fed, ECB, or Bank of England, which are fighting rising costs for services, not goods, and slowing their economies is not an option.

The FxPro Analyst Team