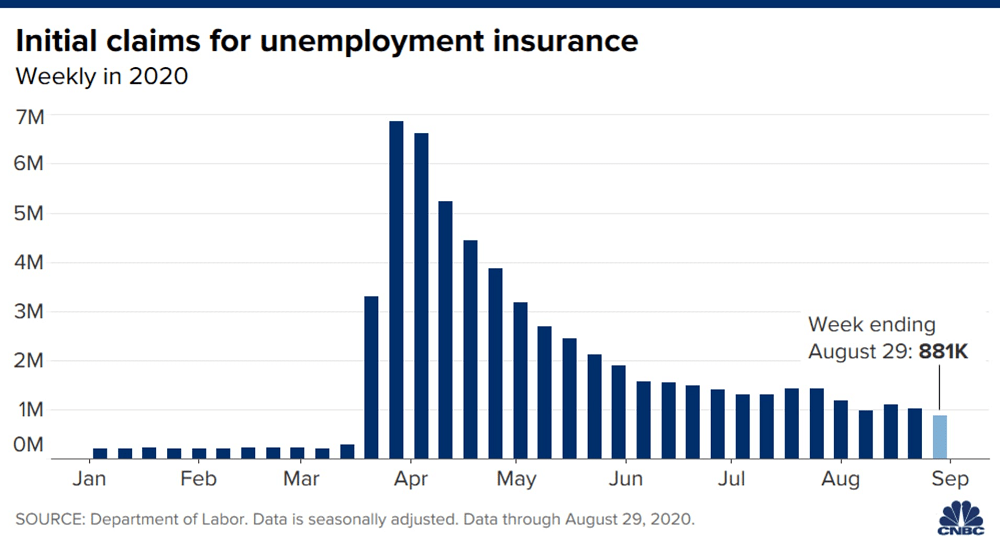

New filings for jobless claims totaled 881,000 last week, better than estimates as the employment market continued its gradual progress during the coronavirus pandemic recovery. Economists surveyed by Dow Jones had been looking for a total of 950,000.

The number reflects an improving labor market as well as a change in methodology from the Labor Department to address seasonal factors. Unique circumstances associated with the coronavirus likely caused jobless claims totals to be overstated during the pandemic.

While the number represented a drop from previous weeks, those totals were not revised, making comparisons difficult. However, the department did note that claims for the week ended Aug. 29 did represent a decline from the previous week’s 1.011 million. Using the old methodology, the total would have been 1.02 million, according to Ian Shepherdson, chief economist at Pantheon Macroeconomics.

Continuing claims fell sharply, dropping by 1.24 million to 13.254 million. The insured unemployment rate, a basic calculation of those getting benefits against the total labor force, fell by 0.8 percentage points to 9.1%.

The Labor Department changed its methodology from one that used seasonal adjustments to account for normal disruptions in the job market that don’t apply as much under the virus-related conditions. The unadjusted total, which has consistently run below the adjusted numbers during the pandemic, was 833,352 last week, up nearly 8,000 from the previous week.

The claims number comes a day ahead of the government’s closely watched nonfarm payrolls report for August. Economists expect 1.32 million more jobs to have been created and the unemployment rate to fall from 10.2% to 9.8%.

Weekly jobless claims total 881,000, better than expected as labor market continues to heal, CNBC, Sep 3