USD

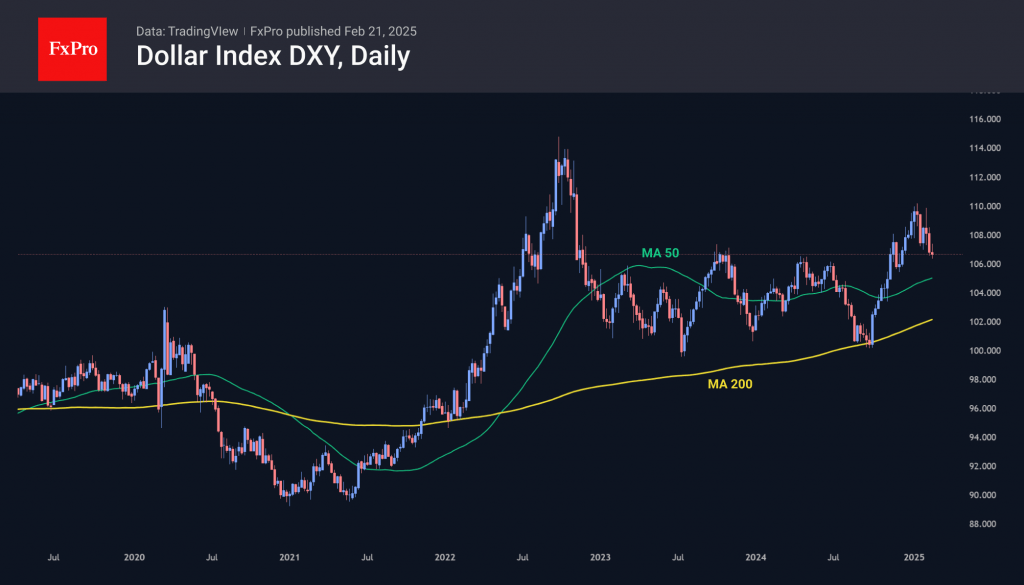

The dollar attempted to regain strength but struggled despite strong fundamentals like monetary policy. The DXY climbed from 106.5 to 107.3 early in the week but lost nearly all its gains by the end.

Shifting rate expectations worked against it, with markets lowering the chances of the Fed holding rates steady until year-end from 22.5% to 16%. Meanwhile, the probability of two or more rate cuts rose to nearly 50% from under 40% the previous week.

With no major new data, markets focused on the softer stance of other major central banks. However, dollar weakness masked broader struggles in other currencies.

AUD

Australia made its first rate cut of the cycle this week, cutting the rate by a quarter point to 4.1%. The previous cut was in November 2020, and the rate hike cycle started in May 2022. However, accompanying comments from the RBA indicate heightened concern for further moves.

The Australian Central Bank’s unwillingness to fully engage in policy easing has allowed the Aussie Dollar to return to its past two-month highs, forming a smooth reversal from the bottom.

GBP

UK consumer inflation rose to 3%, surpassing expectations and staying above the 2% target for over 40 months. Producer prices are virtually unchanged year-on-year and are not a major contributor to final inflation.

However, the initial market reaction was a sell-off in the Pound due to fears that it was losing its purchasing power, as the latest inflation figures would not stop the Bank of England from further easing.