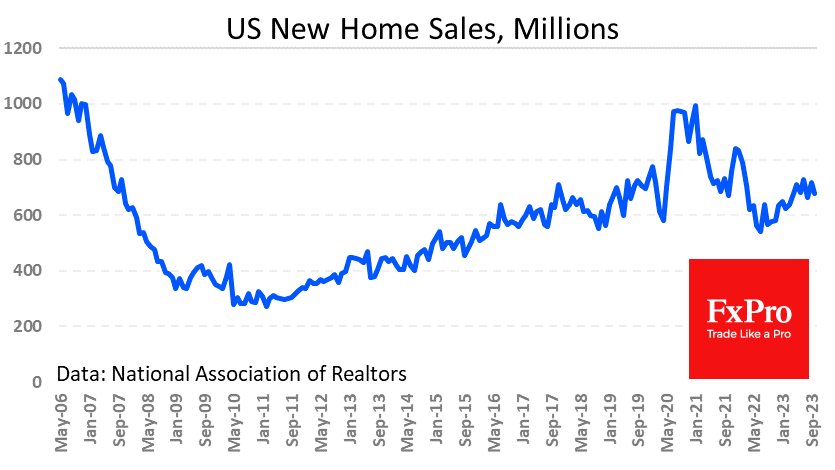

The US new home sales report came out weak on several key aspects. Sales fell 5.6% m/m to 679K vs 719K a month earlier (revised from 759K). The median price of a home sold in October was 409.3K, down 3% from 422.3K a month earlier and 17.6% below the peak of 496.8K set precisely one year ago.

Previously, new home sales had been on a moderate upward trend since last July, contrary to a drop in existing home sales. Households were holding off on secondary home sales, unwilling to switch from mortgages at the low rates of the past few years. In addition, new housing was becoming a bit more modest, given falling home prices, contrary to overall inflation.

The latest report puts the focus on the health of the US banking sector with redoubled attention, raising the spectre of a mortgage crisis and later a global world financial crisis.

In theory, weakness in the US housing sector brings the point of interest rate cuts closer. But in practice, such a reason for policy easing cannot be considered favourable for markets, as it would be a reaction to a significant drop in consumer activity and tighter financial conditions – an obvious bearish sign for equities and other commodities.

The FxPro Analyst Team