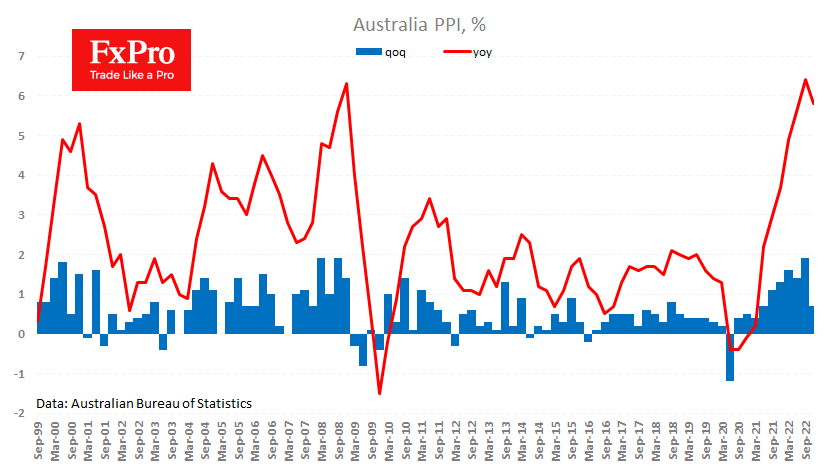

Australian inflation remains an important topic for the forex market as it tries to determine the central bank’s next steps in monetary policy. In contrast to the consumer inflation figures released earlier in the week, producer prices were surprised with weak growth. They rose 0.7% last quarter (1.7% was expected), with the annual rate slowing from 6.4% to 5.8%.

With producer inflation outpacing consumer inflation, it is reasonable to expect inflationary pressures to ease in the next quarter. Interestingly, the PPI growth rate in Australia is lower than that of the CPI. The former peaked at 6.4% in the 3Q22 quarter, and the latter – at 7.8% in 4Q22.

This willingness (and ability) of retailers to pass on costs to consumers is due to strong domestic demand, which the central bank can counter by raising interest rates further to cool domestic demand and an overheated labour market.

The cooling of producer inflation strengthens the argument that another 25bp hike at the next meeting on 7 February will be sufficient. On the other hand, the high increase in consumer prices suggests that there will be several hikes before the RBA pauses.

Today’s data from Australia halted the AUDUSD’s growth above 0.7130 and dropped the pair below 0.7100. From here, the pair also reversed to a decline in August.

The FxPro Analyst Team