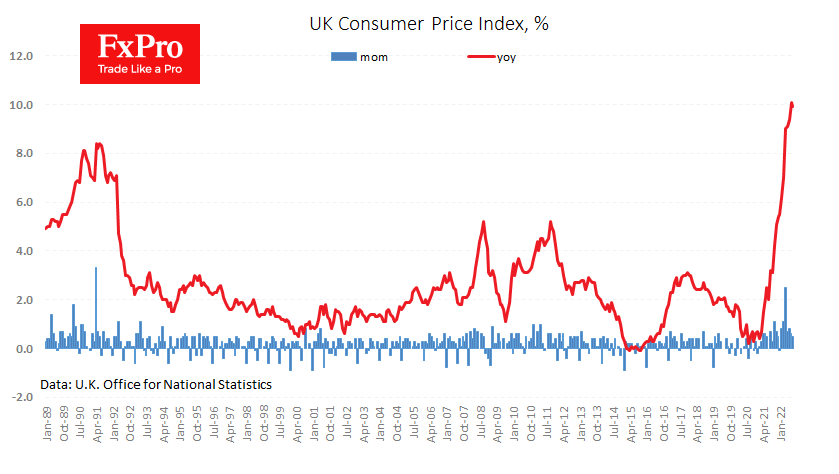

The inflation report marathon continues; it was the UK’s turn this morning. Traditionally, the consumer price change figures attracted the most attention. For the month, they rose by 0.5% (slightly less than the 0.6% expected), and annual inflation fell from 10.1% to 9.9%, slightly weaker than the 10.0% expected.

As previously with the US data, core inflation exceeded expectations, reaching 6.3% – a new all-time high. However, there are several signs that the inflation wave has subsided.

Producers reduced their selling prices for the first time in almost two years. The reduction was a nominal 0.1%, but we should expect more. This indicator’s annual rate of increase fell from 17.1% to 16.1%.

Producer input prices (an even earlier indicator for inflation) lost 1.2% in August – the largest since April 2020. By the same month a year earlier, growth had slowed to 20.5% compared with 22.6% in July and 24.1% in June.

It is also worth remembering that the effect of the high base (there were already higher price growth rates at this time a year ago) will weigh on the annual inflation figure.

After we saw a sharp rise in the dollar on hot inflation from the US, one could have expected a new wave of pressure on the Pound on weak data. But that did not happen, for which there is a logical explanation. The news in the US caused a revision of rate expectations, but this is not happening in the UK markets.

Lower inflation puts less pressure on Sterling’s purchasing power. In the longer term, this will help reduce the shock to the economy from tightening monetary policy, which is positive for the currency.

The FxPro Analyst Team