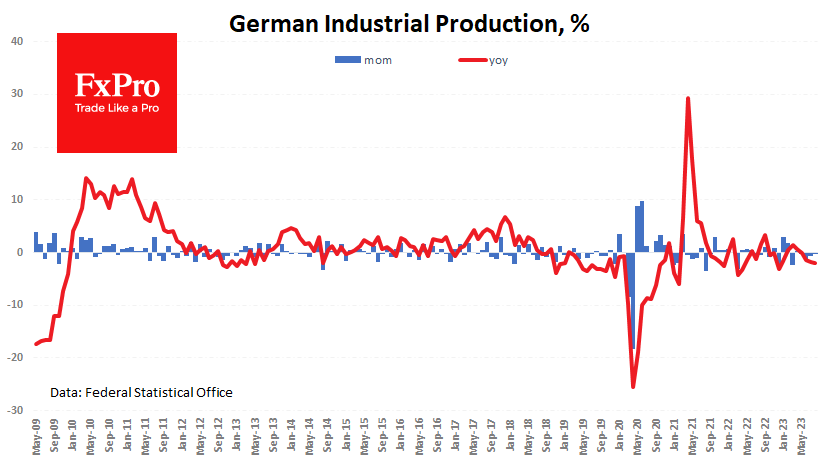

German industrial production contracted for the fourth consecutive month in August, missing expectations. Last month’s loss was 0.2%, bringing the year-on-year decline to 2.0%.

Germany’s industrial production index started on a downward path at the beginning of 2018, which is easier to link to the outbreak of trade wars with China than to coronavirus, expensive energy and high interest rates – crises that have succeeded each other over the past four years.

The day was not packed with meaningful releases, so the publication of data from Germany was the second most significant reason for the euro movement today after the Middle East hostilities. EURUSD lost 0.3% on the publication of the statistics, pulling back to 1.0525.

The downward trend temporarily failed to develop thanks to the rebound of stock indices and accumulated oversold conditions in the euro. The market played this up last week. Still, new fundamental factors acting against the single currency may encourage an earlier end to the corrective rebound and put the pair back on the downward path.

The FxPro Analyst Team