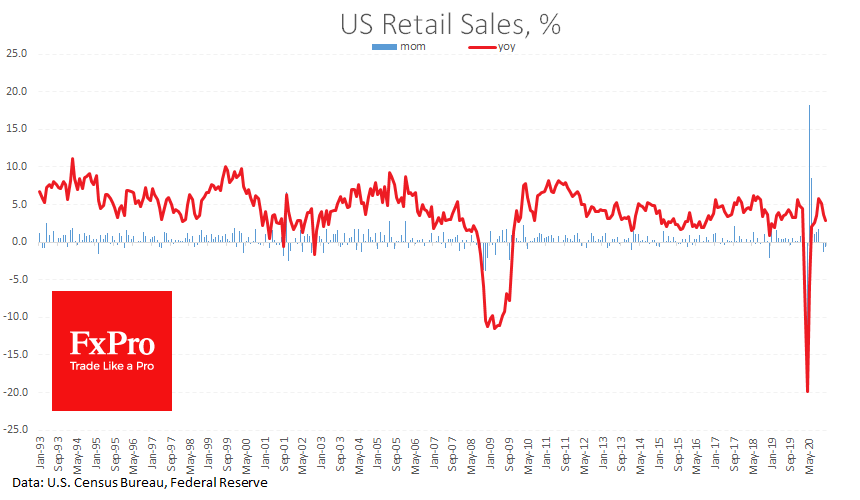

Earlier we urged traders not to attach too much importance to rising jobless claims, but with the very weak retail sales report today we now have a more alarming signal of a waning US recovery.

In December, headline sales fell 0.7% after dipping 1.4%, marking the third consecutive month of decline. Ex-auto and gasoline sales fell 2.1% after declining by 1.4% and 0.1% in the previous two months.

The drop in sales is hardly a surprise to US politicians, as both Trump and Biden promoted the idea of providing $2000 cheques to Americans.

The drop in sales underlines the need for support, which for the most part is already agreed and factored into market prices. Therefore the negative effect of the weak data in the USA could be mainly psychological and short-term in nature. It would not be surprising if the drawdown in equities and commodities forms a buying spur on the downturn in the next couple of weeks.

The FxPro Analyst Team