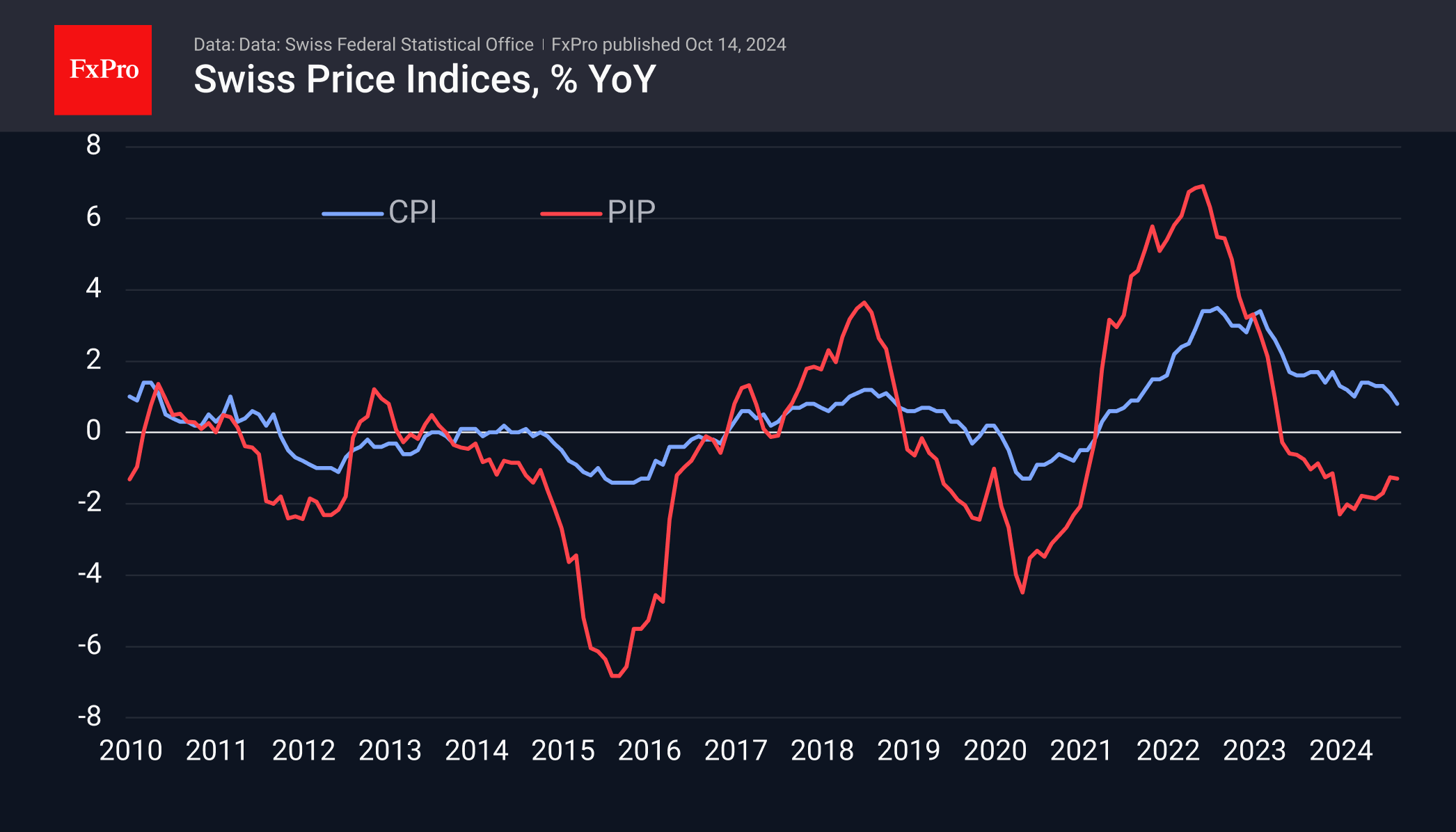

Swiss inflation continues to surprise on the downside, with the PPI falling by 0.1% m/m in September versus expectations for a rise of 0.1%. The year-on-year decline accelerated to 1.3% from a 1.2% contraction in the previous month (-0.3% expected).

The weakness in producer and import prices supports the idea that Swiss monetary policy could be eased further in the coming months. Estimates for September consumer inflation also showed a slowdown to 0.8% year over year. The negative annual trend in producer prices promises to continue dragging down consumer inflation.

Weak inflation, as in the case of China, is fundamentally negative for the local currency. The USDCHF has gained 0.8% since the start of the day on Monday, accelerating its gains after today’s inflation report and roughly copying the amplitude of the Dollar Index’s rise since the lows at the end of September, up 3%. Next upside resistance for the pair could come in the form of the previous local highs at 0.8720 and beyond in the form of the 200-day moving average at 0.8810.

The FxPro Analyst Team