Germany data

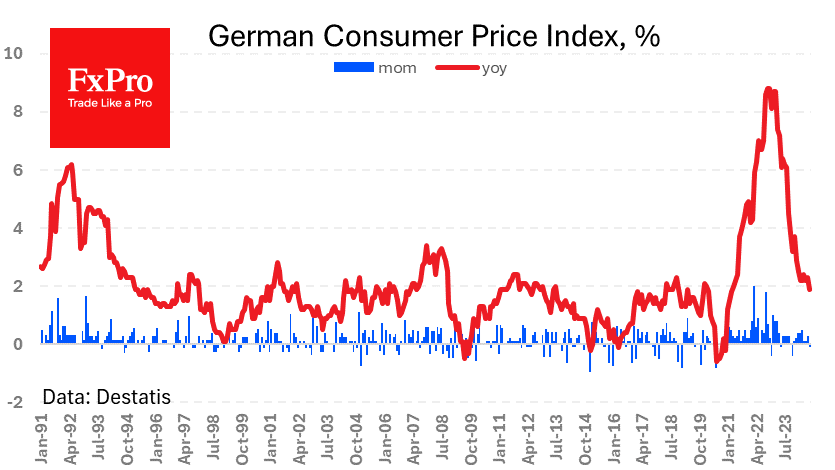

German inflation is slowing more than expected. According to a preliminary estimate from Destatis, the consumer price index fell 0.1% in August, and annual inflation slowed to 1.9%, compared to 2.3% in the previous month and the 2.1% expected.

Germany released state-specific data later in the day, and the weak readings put pressure on the Euro. The weakness in inflation is further evidence of a limping economy. The data will also weigh on Friday’s Euro-zone CPI estimates. At the start of the week, the average forecast was for a decline from 2.6% to 2.2%, but after the German data, a slowdown to 2.0% would not be too surprising.

The EUR/USD pair fell back to 1.1070 on the news. Since the beginning of the week, we have seen negative surprises in other macroeconomic data from the European economy’s locomotive.

US data

At the same time, macro data from the US continues to be strong. A revised estimate of Q2 GDP growth is 3.0% from 2.8%, and there is a drop in weekly jobless claims from 233K to 231K. Continuing claims rose from 1855K to 1868K. In both cases, these are stronger than expected readings (short-term positive) at historically low levels (long-term positive).

This solid data makes us question the appropriateness of a 50-point cut in the Fed Funds rate in September. However, the futures market is pricing in a 33% chance of such an outcome (67% in favour of a 25-point cut), leaving the potential for dollar strength on a reassessment of expectations. The Fed and the markets are unlikely to make a final decision until after the employment data in early September and the inflation data in the middle of next month.

The FxPro Analyst Team