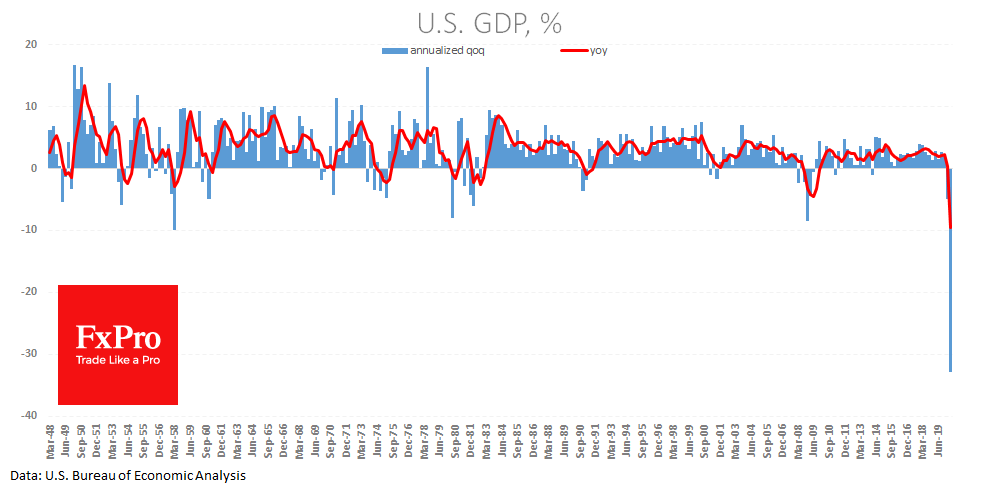

The annualized drop in US GDP for the previous three months is estimated at 32.9%, against expected -34.5%. The decrease from the same quarter one year ago was 9.5%. By a wide margin, it is the sharpest decline in the available history since 1948.

Initial jobless claims rose for the second consecutive week to 1,434 M (vs 1.44 expected). The continued claims number has once again surpassed 17M. This was the first increase since May when quarantine easing began.

This creates a negative backdrop for the demand for risk assets. In the short term, it puts pressure on the Dollar, as investors assume that the Fed will have to soften the policy tone further or keep the rates around zero for longer. However, the increased sell-off in the markets may quickly return the Dollar to growth if investors start looking again for protection from market turbulence in treasury bonds.

The FxPro Analyst Team