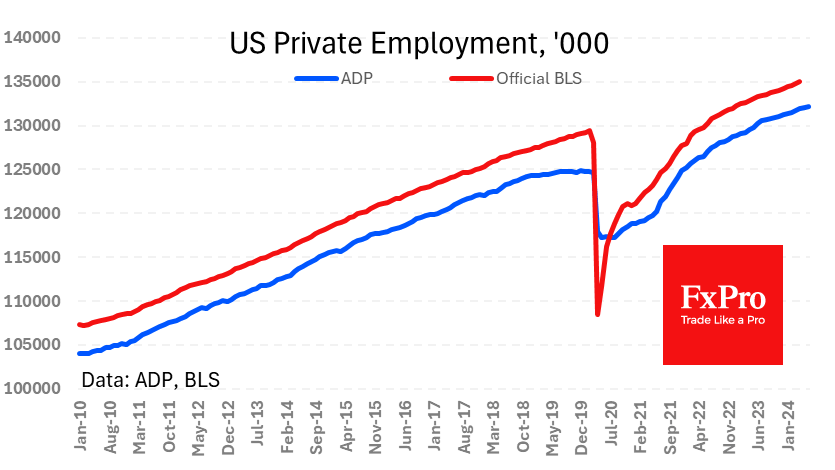

The US private sector created 150K jobs in June, according to fresh ADP estimates. This is slightly weaker than expected and the lowest growth since January. Once again, the leisure sector (+63K) led the growth. Construction stands out, with net job growth of 27K for the month and nearly 3% growth in the last seven months of accelerated hiring, which is surprising given the collapse in lumber prices, the proxy for construction activity. Falling employment in mining (-8K) and manufacturing (-5K) acts as a wake-up call. Impressive growth momentum remains in the service sector, continuing to be a pro-inflationary factor.

Weekly jobless claims continue to signal a new phase in the labour market. The four-week moving average of initial claims climbed to 238.5K, adding 15.5K for the month. The same indicator for continued claims rose by 45K. Such indicators retain a theoretical chance of negative data on employment change of NFP numbers due on Friday. Remember that analysts, on average, expect +190K.

Indicators of foreign trade activity present another batch of negative data. The trade deficit widened to 75.1bn in May—the highest since October 2022. The driver is the accelerated growth of imports (+6.2% y/y) vs exports (+4.3% y/y). Export volumes reached a plateau in September, while imports have been on an upward trend since last August.

Altogether, this is negative news for the dollar, suggesting increased pressure due to trade and signs of a reversal in the labour market trend, bringing a rate cut closer. According to FedWatch, the market gives a 68% chance of a rate cut in September versus 62% a week ago and 59.5% a month ago.

The FxPro Analyst Team