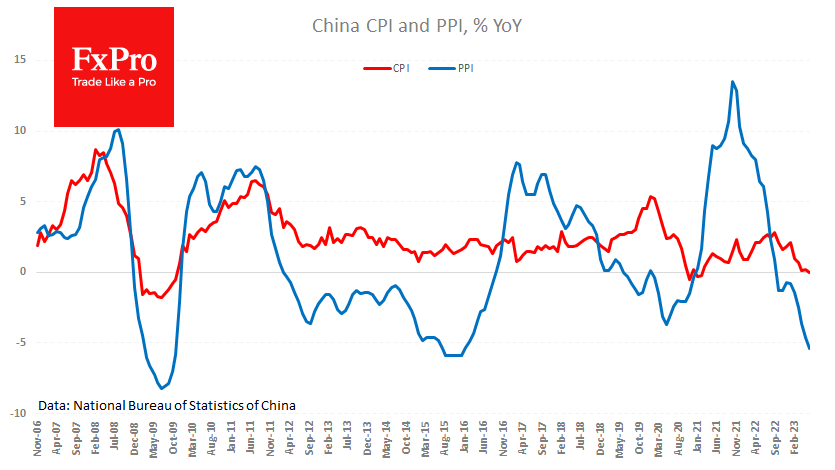

A further slowdown in China’s inflation is increasingly raising concerns about the Celestial Empire’s economic growth, which could be bad for the rest of the world.

June data showed that CPI fell from 0.2% y/y to 0.2% y/y and PPI from 4.6% y/y to 5.4% y/y. The data were weaker than expected at 0.2% y/y and -5.0% y/y, respectively, highlighting the persistence of deflationary pressures in the country and reflecting weak consumer and corporate demand, respectively.

The weak inflation figures are fuelling speculation about further stimulus from the Chinese government. Given the size of the Chinese economy, news about it impacts global market dynamics.

China’s weakness is bad news for markets until it triggers the Government stimulus measures. But we are still hearing nothing new about them, so markets remain nervous.

Moreover, today’s news adds to the pressure on the yuan. In a classic case of weak inflation, the central bank tends to cut interest rates, sending capital in search of higher yields in overseas debt markets. Alternatively, the central bank may try to stimulate the economy through a weaker yuan, thereby increasing export competitiveness and imported inflation.

In other words, USDCNH is unlikely to have peaked late last month. It will likely continue its uptrend to levels above 7.30 unless there is a significant change in the economic data.

The FxPro Analyst Team